2buffalo

WKR

- Joined

- Mar 4, 2022

- Messages

- 421

You proved that? Where? If you read what I said, I never suggested a wealth tax.

That said “unrealized” gains to purchase something is an oxymoron. That’s income, full stop

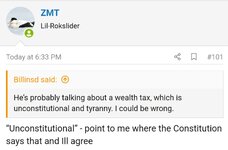

See above. Article 16 does not mention taxing assets and provided Article 16 therefore I proved an asset tax is unconstitutional. Pretty straight forward i apologize if it was confusing. I never said you suggested.

Have you heard of home equity loans? You can borrow off your asset without paying taxes. Not that unusual. Neither is an SBLOC loan.