Danny Hoey

WKR

Snagged another 30 shares of UUUU. Long term hold, with flips in between. Usually doesn't stay under 6 for long.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Ive been contemplating selling my GTE and dumping it in UUUU. Good day to get in. Have you looked at URG? Similar to UUUU but cheaper.Snagged another 30 shares of UUUU. Long term hold, with flips in between. Usually doesn't stay under 6 for long.

I have not. Trying to stay diversified and I'm pretty deep in UUUU.Ive been contemplating selling my GTE and dumping it in UUUU. Good day to get in. Have you looked at URG? Similar to UUUU but cheaper.

$1/share Q2 divi?Yep, that's nicely summed up I'd say.

That $1-a-share upcoming Q2 divi is a helluva perk, but as you alluded, the barcode has been exhausting.

Being that I work in banking...... this really beat up my retirement portfolio. Luckily I have time on my side.The SVB story is worth a look as to the “Why” they are undercapitalized.….

could be the one cockroach theory.

The variable dividend is supposed to be paid out quarterly along with the base dividend. I ended up selling all of my PR on Monday figuring we would have another pull back to low 10's - high 9's.Well, I thought PR had proposed two dividends, the .05 quarterly and a one-time special divi. Aggravating.

I posted on this at the ST and received this from another:

View Full Conversation

Yeah, I figured that the two divis would be the case after the latest read. lol. I initially thought the variable was a one time payment rather than a 1/4ly.The variable dividend is supposed to be paid out quarterly along with the base dividend. I ended up selling all of my PR on Monday figuring we would have another pull back to low 10's - high 9's.

Bizarro world continues, there is still just too much reckless greed in the market. Silvergate Capital. The TLDR story for anyone not following: most shorted stock in the US for a couple months in a row because of serious financial issues somewhat associated with the FTX/Alameda/BTC fallout and just the general crypto fast and loose, irresponsible behavior. Reddit Meme Stock crowd tries to squeeze the shorts last week or the week before, fail on more bad news out of Silvergate, then yesterday Silvergate announces they're closing up shop. Stock tanks as money rushes out after hours yesterday. Then the speculators and Reddit crowd emerge from the shadows to BTFD (buy the ___ dip) and the stock is back up something like 50% since its after-hours low yesterday.

I can only guess what they're betting on -- government bailout, or some other crypto company stepping in to bail them out or buy them out. Or just they're counting on the gambling/speculation that is playing out just like it has been since 2020. But this is literally a company that just announced they are closing because they can't pay their debts. So stupid...

EDIT: I should add, stupid TO ME as a guy that doesn't have the stomach for "trading." Probably doesn't seem so stupid to the gamblers that are up 50% since yesterday.

The FED response has been just that, they will protect the deposits but not the bank.If the Fed doesn't step in and ensure the depositors (not the bank or investors),

Ah yeah, SIPC coverage too, I never think about that one, only FDIC.You have SIPC for brokerage accounts at $500000, including up to $250000 cash protection.

I think if you and another half million people bail in am it’s just going to trash the market. Which may happen anyway. Another thing, i think funds only settle at end of day so you may not gain anything or may lose quite a bit over sitting tight

but what do I know… Basement Biden seems to be succeeding in trashing the country

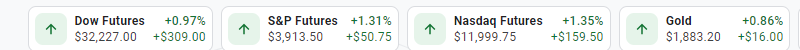

Yes, I'm surprised to see this all of these, but am especially glad to see the last price update.Futures are ripping higher. +1.5%

I’m having flashbacks to the Covid crash of massive swings and volatility…

Also, anybody going to jail over this? Cuz us taxpayers just bailed out some millionaire peckerhead because of his bad decisions…