Everyone's insight is super helpful in this thread, I appreciate all of the info people have and different perspectives. I wish I would have left my investments alone when I was in my early 20s, would be light years ahead of where I am currently. Oh well, I will keep chipping away at debt and keep investing for retirement and a little play money doesn't hurt too bad.

I've read differing opinions on setting stop losses and am wondering some of your thoughts. Do you set them at a percentage below your buy in or do you just hold and hope for a rebound? I'm sure it depends on what the stock is, but how do you play it?

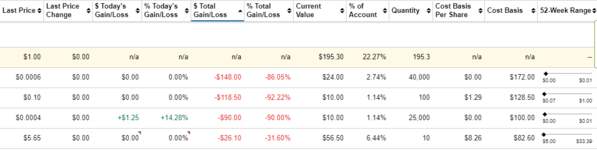

I've set up stop losses around 25% of my buy in, but I'm only playing with about $2k, my risk tolerance is mostly high so should I just hold?

Sent from my SM-G991U using Tapatalk

I've read differing opinions on setting stop losses and am wondering some of your thoughts. Do you set them at a percentage below your buy in or do you just hold and hope for a rebound? I'm sure it depends on what the stock is, but how do you play it?

I've set up stop losses around 25% of my buy in, but I'm only playing with about $2k, my risk tolerance is mostly high so should I just hold?

Sent from my SM-G991U using Tapatalk

I’m not that old.

I’m not that old.