Mosby

WKR

- Joined

- Jan 1, 2015

- Messages

- 1,939

Great in theory but we are already paying taxes that were supposed to pay for road and highway maintenance. It is quickly diverted after collection. Trucking companies pay over $40 billion in state and federal road use fees. Think it goes to pay for the roads we use? Much of it doesn't. We pay gas taxes every time we pump a gallon. That was supposed to go for the roads and bridges too.In the big picture, a mileage tax makes sense as it is passing the cost of highway maintenance to those who use it most, akin to a consumption tax.

Having said that, the application by this administration likely has political overtones as much or more than fiscal ones, so I doubt I will be supportive of how this would be implemented - especially in the context of existing gas taxes that are charged at the state level for this sort of funding.

Every time they want to raise taxes they use road maintenance or schools as the benefactor but that is just for political purposes. PT Barnum was right. We are suckers.

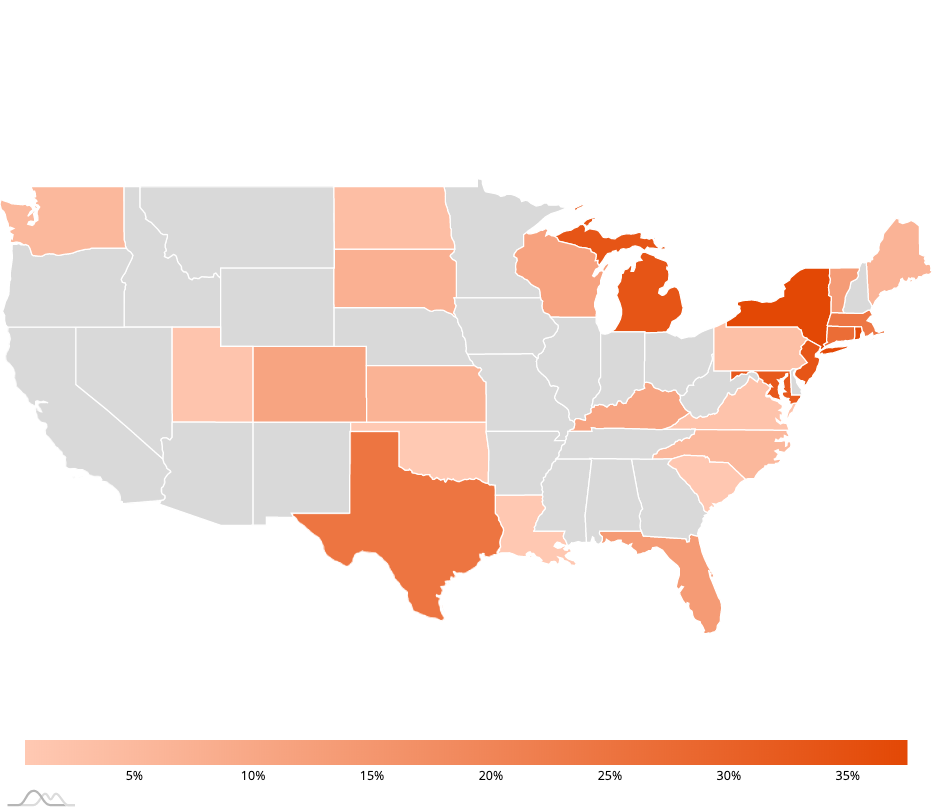

How Much Gas Tax Money States Divert Away From Roads - Reason Foundation

Examining the percentage of state gas tax revenue that is allocated for expenses unrelated to roads, including money shifted to law enforcement, education, tourism, environmental programs and more.