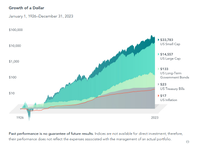

I agree with some of your points, but the " absolutely outpacing inflation" clause, I have issue with. Lots of shells being moved around when measuring actual price increase per specific entity of material...and if you can guarantee me 10% return for the next 25 years, I will send you a bunch of capital.

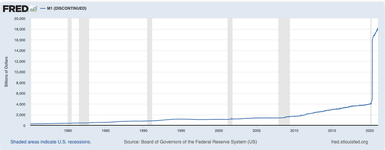

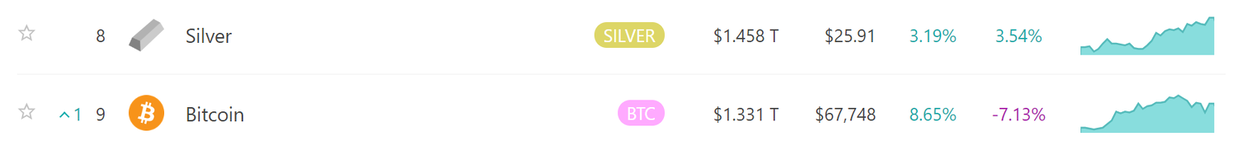

The reason BTC is going up is because there is a limited amount available, the reason prices are going up is the dollar is worth less every year. It's lost a triple digit percent of buying power in the last 100 years.

The fact that you have to have your money, make money is correct, that's the only way you can hope to make up for the difference of buying power that inflation robs you of....but wages haven't kept pace...and we are in a situation where a person is going to be a landowner, or they're not. If your family doesn't own land, you won't ever make enough to buy any. Farm ground near me has gone from 3200/ac in 2005 to 16,000 today. Pretty sure the " diversified market " returns have not done that....Most assets are just out of reach for the average guy now. Sad day for all of us, our leadership has failed us with their monetary policies.

The reason BTC is going up is because there is a limited amount available, the reason prices are going up is the dollar is worth less every year. It's lost a triple digit percent of buying power in the last 100 years.

The fact that you have to have your money, make money is correct, that's the only way you can hope to make up for the difference of buying power that inflation robs you of....but wages haven't kept pace...and we are in a situation where a person is going to be a landowner, or they're not. If your family doesn't own land, you won't ever make enough to buy any. Farm ground near me has gone from 3200/ac in 2005 to 16,000 today. Pretty sure the " diversified market " returns have not done that....Most assets are just out of reach for the average guy now. Sad day for all of us, our leadership has failed us with their monetary policies.