Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

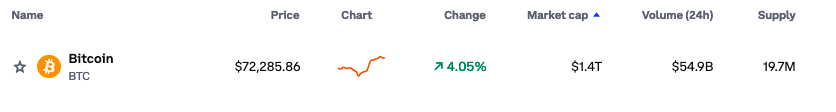

Bitcoin

- Thread starter Split toe

- Start date

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 1,557

Sorry had too haha. It was nice to wake up to the pump after the weekend was slow. MSTR purchased $800 million over the weekend.

Sent from my iPhone using Tapatalk

Historybuff

Lil-Rokslider

- Joined

- Jan 28, 2017

- Messages

- 268

wind gypsy

"DADDY"

- Joined

- Dec 30, 2014

- Messages

- 13,230

Bought about $25k worth of ETH and BTC in 2016. Unfortunately I've already enjoyed most of the fruits of that decision. Kind of bummed I didn't hop back on the train a year ago when my buddy was pushing me to do so..

Last edited:

william schmaltz

WKR

Hell ya, that boss purchased 12k more today. I love listening to Michael Saylor interviews when they try to talk trash and he goes in on em. I’ve yet to see anyone put together a valid argument against him.

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 1,557

UK to allow BTC ETF for “professional investors “ bc we would hate for the normies to have assets. BTC is moving into liquidity it has never had access to before. Just starting.

Sent from my iPhone using Tapatalk

PokeTheBear_

FNG

- Joined

- Feb 15, 2024

- Messages

- 15

Done pretty well with btc… the secret is that my wife just does the exact opposite of what I say with it. I say sell! She buys more. I say Hold! And she knows it’s time to sell. It’s been a shockingly effective strategy.

I sold the last of my BTC today. Roughly tripled my bet. The more I use and study Bitcoin the more I think it will be really volatile for the mid-to long-term and then eventually fade away. I do agree wholeheartedly "everyone will ultimately buy Bitcoin at the price they deserve"  here's to all y'all proving me wrong and getting fabulously wealthy and saving the world from its corrupt financial system

here's to all y'all proving me wrong and getting fabulously wealthy and saving the world from its corrupt financial system

*zap*

Savage

Kudos to those who killed it.

Yes. My largest holding is BTC followed by ETH then SOL.I might as well ask is anybody in on any ETH or SOL?

Tjdeerslayer37

Lil-Rokslider

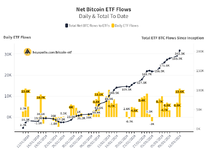

can you explain this to me in simpleton terms? The ETFs are purchasing theoretical bitcoin at this point? doesnt that cause artificially inflated prices by buying up coins that arent produced yet? does that create a danger of crashing? please excuse my ignorance

My understanding from reading a few of the ETF prospectus’ is that the ETFs will hold actual bitcoin through a custodian. For a large majority of the ETFs, Coinbase is that custodian. So you could think of ETF purchases as asking someone to buy and hold bitcoin on your behalf, similar to a gold ETF.

So that chart is showing:

1. High inflows of capital to the ETFs for purchasing bitcoin

2. Demand currently higher than rate of mining (new supply)

Sent from my iPhone using Tapatalk

So that chart is showing:

1. High inflows of capital to the ETFs for purchasing bitcoin

2. Demand currently higher than rate of mining (new supply)

Sent from my iPhone using Tapatalk

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 1,557

can you explain this to me in simpleton terms? The ETFs are purchasing theoretical bitcoin at this point? doesnt that cause artificially inflated prices by buying up coins that arent produced yet? does that create a danger of crashing? please excuse my ignorance

The ETFs are buying from OTC holdings. When they buy btc it is then held by a custodian, for example coinbase. If the inflow of $ continues the OTC reserves will dry up, once that happens buying will happen on exchanges. there is not enough btc on exchanges to handle more than a day of buying, currently.

Once the halving occurs the daily issuance of btc will be cut in half. Demand will out pace supply.

Sent from my iPhone using Tapatalk

Bitcoin has reached new all time highs 3 times this week. If you lost money on Bitcoin then you sold it too soon.I lost a cool 10 grand in that deal lol

Similar threads

- Replies

- 7

- Views

- 677

- Replies

- 51

- Views

- 2K

Featured Video

Latest Articles

- James Yates: Leveraging Data for Archery Excellence

- How Old Was He Really? Big Buck Hunters Talk Age vs. Score

- Banning Hunting Technology in Idaho?

- Best Gear of the year Rokslide staff edition 2025 Article

- Hunting Gear: Insights from Western Hunting Expo

- Black Diamond Alpine Start Insulated Hoody Review

- Tenacity Firearms with Andrew Whitney

- The Thrill of Moose Hunting with Henry Ferguson

- Final Rise Upland Hand Muff Review

- Kodiak Deer Hunt Round II