Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Credit Card Rewards 2.0

- Thread starter treillw

- Start date

Where's Bruce?

WKR

- Joined

- Sep 22, 2013

- Messages

- 6,387

I get 2% cash back with Cap 1. Best deal I've seen.

HuntHarder

WKR

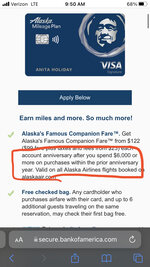

Pretty sure that is new. I don't remember thatWas thinking about picking up and Alaska Airlines card before a moose hunt I have this September, but I see they have upped the annual fee and have you always needed to spend $6,000 a year to get the companion fare discount??? View attachment 510087

- Banned

- #44

GringoBling

WKR

I had the Chase Sapphire Reserve since its inception, but just recently converted it to the Chase Sapphire Preferred once the CSR fee increased to $550. CSP is great for travel benefits. We fly American mostly and I can transfer Chase points to British Airways, which allows you to book award travel with AA. We also stay mostly at Hyatt properties and can transfer Chase points directly to Hyatt for free nights. We also have Amex Platinum which allows entry to the Centurion Lounges around the country – they are incredible.

Since I mostly fly on AA, it makes sense to have the AA Citi card, which gives me and my guests free checked bags and “priority” boarding. It pays for itself ($95 annual fee) with one family trip.

And since I fly to Gunnison, CO at least a couple times a year, I have the Chase United Visa. I have NEVER paid for a flight to Gunnison…every single trip has been with miles. This card also gives you free checked bags, as well.

Since I mostly fly on AA, it makes sense to have the AA Citi card, which gives me and my guests free checked bags and “priority” boarding. It pays for itself ($95 annual fee) with one family trip.

And since I fly to Gunnison, CO at least a couple times a year, I have the Chase United Visa. I have NEVER paid for a flight to Gunnison…every single trip has been with miles. This card also gives you free checked bags, as well.

- Banned

- #45

GringoBling

WKR

That crushes your credit.

Like others have said, that's just flat out false. There is a whole cottage industry of people with excellent credit who play the system opening new cards to get the start-up bonuses. I used to regularly open 1-2 new cards a year and it never dropped my FICO below 800.

Aaron-in-CO

Lil-Rokslider

Amex Blue Cash Everyday

- 3% online retail

- 3% gas

- 3% grocery

- no annual fee

Citi Double Cash

- 2% everything

- no annual fee

Piggyback the online purchases with Activejunky.com for extra cash back (2-12%) from outdoor related retail websites.

- 3% online retail

- 3% gas

- 3% grocery

- no annual fee

Citi Double Cash

- 2% everything

- no annual fee

Piggyback the online purchases with Activejunky.com for extra cash back (2-12%) from outdoor related retail websites.

NRA4LIFE

WKR

Alaska Airlines and Amazon (especially if you use them a lot).

commandoNate

WKR

I have the Scheel’s Visa. Their rewards are store gift cards with no expiration date. As a self employed contractor I can put sometimes 15-20K on this thing in a month purchasing materials for projects that we are working on. This can net me $100-$200/month in gift cards! Bought one of the kids a new bow last weekend with gift cards. I’ve got a new elk rifle in mind and I should be able to get it at no cost to me by the end of this year.

Interesting. Given credit age and credit inquiries account for ~25% of your credit score, it seems like that sort of strategy would have to have a negative impact on credit score. Now, "crush" your score? I highly doubt it.Like others have said, that's just flat out false. There is a whole cottage industry of people with excellent credit who play the system opening new cards to get the start-up bonuses. I used to regularly open 1-2 new cards a year and it never dropped my FICO below 800.

- Banned

- #50

GringoBling

WKR

Hard inquiries only cause slight drops to your FICO- like 5 points. And those inquiries typically only are factored into the models for about 6 months. Credit utilization, time on file, payment history, delinquencies, debt to credit ratio, etc. plays a much larger factor on your score.Interesting. Given credit age and credit inquiries account for ~25% of your credit score, it seems like that sort of strategy would have to have a negative impact on credit score. Now, "crush" your score? I highly doubt it.

I should also mention, I pay my bill in full every month. That's the only way to be in the black with credit card benefits.

It sounds like many people also use this strategy to pay off debt, which likely offsets the negative impact of inquiries and shortening the average credit age.Hard inquiries only cause slight drops to your FICO- like 5 points. And those inquiries typically only are factored into the models for about 6 months. Credit utilization, time on file, payment history, delinquencies, debt to credit ratio, etc. plays a much larger factor on your score.

I should also mention, I pay my bill in full every month. That's the only way to be in the black with credit card benefits.

One thing I have noticed recently is that, even with paying off my cc balances every month, if I run up large intra-month balances it has a pretty significant negative impact to my FICO score. You'd think the models would see that I have paid off every balance monthly for the last 10+ years, but they do not seem to. When my balances get above $6K-8K for a couple of weeks, I get a notice from Experian showing a big ding.

Edit: odd timing, but literally just got an update that my FICO increased 19 points by paying off my monthly balances. Seems like a big swing for something that happens every month like clockwork.

Last edited:

Dos Perros

WKR

Who cares what your credit score is as long as it's ~750+. There is no benefit to 800 or 820 vs 750. At 750 you're already qualifying for the lowest rates, best loan terms, etc.

thedutchtouch

Lil-Rokslider

- Joined

- Sep 2, 2021

- Messages

- 184

Also an Alaska airlines card user here. I applied using one of the in-flight offers, between the points that came with that (it was like 67000 or something close) and general use, I've "paid" for one ticket already and have points for 1-2 more depending on connections. Even at 100 bucks a year fees it's still cheaper than a flight from MD to any point in AK, I treat it like I'm buying a round trip ticket for 100 just need to decide when to go. Add in the baggage fees and companion fare options and it's a great buy to me. With normal use it's pretty easy to spend 6k on a card in a year, that's 500 a month, autopay your utilities and your cable/phone bill/streaming stuff and you're almost there, don't even have to carry the card around. (I use it for a lot more than that this the miles earned, this strategy is suggested as a baseline).

The paceline visa signature card is pretty interesting. It pays 3% cashback across the board if you work out for 150 minutes a week. Tracking is done by a heart rate monitor and their app. Need to be over about 120 bpm from what I understand. 5% back on some other things.

If you don't meet their criteria, it gives you 1.5% cashback, or 2.5%. I'm wondering how religiously I can work out three times a week for 50 minutes or more.

There is a yearly fee (which isn't terrible) and you have to buy an apple watch or similar which you will be reimbursed for over a period of time. Sounds pretty interesting.

Shame it's not going off of steps - strap the fitbit on a paint shaker

If you don't meet their criteria, it gives you 1.5% cashback, or 2.5%. I'm wondering how religiously I can work out three times a week for 50 minutes or more.

There is a yearly fee (which isn't terrible) and you have to buy an apple watch or similar which you will be reimbursed for over a period of time. Sounds pretty interesting.

Shame it's not going off of steps - strap the fitbit on a paint shaker

diamond10x

WKR

When I got my card a couple years ago you had to spend and payoff $2,000 in 3 months. $6,000 in 12 months is a better deal.Was thinking about picking up and Alaska Airlines card before a moose hunt I have this September, but I see they have upped the annual fee and have you always needed to spend $6,000 a year to get the companion fare discount???

As I read it now, you have to spend $3,000 in the first 3 months to get the initial companion fare and 70,000 miles, then you have to spend $6,000 every year after that to keep receiving the companion fareWhen I got my card a couple years ago you had to spend and payoff $2,000 in 3 months. $6,000 in 12 months is a better deal.

SWFLhntr

Lil-Rokslider

Well I’m at 850 and I like to humble brag about it on the internet.Who cares what your credit score is as long as it's ~750+. There is no benefit to 800 or 820 vs 750. At 750 you're already qualifying for the lowest rates, best loan terms, etc.

Sorry I mis-spoke. The Upside app gives you cash back (CB) at participating stations. The Conoco app just gives you money off per gallon. I use both in conjunction with whatever card is offering the highest CB at the time. Check them out.How does this work?

Earn every time you shop: Gas, grocery, and food | Upside

Earn every time you shop gas, grocery, or food with Upside's free top-rated app. Get cash back on everyday necessities, making your purchases more rewarding. Download and start earning today!

Download the Fuel Forward™ App | Gas Station App | Conoco®

The Fuel Forward™ App makes it simple and fast to pay for fuel at the pump and buy your favorite snacks at the Conoco® convenience store. Download it now!

Like others on here I've been playing the credit card game for some time. I have over 25+ cards open and a credit score over 800 (that's a common myth).

I too still have the Cabela's credit card although I almost never use it. I do keep it open b/c there is no annual fee, it is one of my oldest cards, and length of credit history is one thing that impacts your credit score. Something you might want to consider before closing.

As far as cards go, there are way too many personal variables to make specific recommendation, but I feel like you should at least have a cash back card 2% return across all categories and a rewards program whatever airline/hotel/merchant that you like. Reddit has a nice credit card decision making tree that I've found quite helpful (just google it).

I too still have the Cabela's credit card although I almost never use it. I do keep it open b/c there is no annual fee, it is one of my oldest cards, and length of credit history is one thing that impacts your credit score. Something you might want to consider before closing.

As far as cards go, there are way too many personal variables to make specific recommendation, but I feel like you should at least have a cash back card 2% return across all categories and a rewards program whatever airline/hotel/merchant that you like. Reddit has a nice credit card decision making tree that I've found quite helpful (just google it).

Similar threads

- Replies

- 8

- Views

- 1K

- Replies

- 299

- Views

- 21K

- Replies

- 57

- Views

- 6K

- Replies

- 24

- Views

- 2K

Featured Video

Latest Articles

- How Old Was He Really? Big Buck Hunters Talk Age vs. Score

- Banning Hunting Technology in Idaho?

- Best Gear of the year Rokslide staff edition 2025 Article

- Hunting Gear: Insights from Western Hunting Expo

- Black Diamond Alpine Start Insulated Hoody Review

- Tenacity Firearms with Andrew Whitney

- The Thrill of Moose Hunting with Henry Ferguson

- Final Rise Upland Hand Muff Review

- Kodiak Deer Hunt Round II

- Killing a Timber Giant