VOO has about equal return rates and a .03 expense ratio. Do you think that VGT is a better investment than VOO?

VOO 10 year return is not even Close to the Tech sector ETF's.

Look S&P index stuff is good and I think it should be a part of an investment portfolio. The advantage you have in the S&P index stuff is the powers that be are constantly adjusting it- dumping the losers and adding winners...which is what you want. The S&P is a big part tech already.

Young guy advice;

Investing is all about return AND managing risk. buying individual stocks- like the penny stocks discussed here is SUPER high risk thats why for every one guy making money 25 have lost. Thats a one step forward, 2 steps back strategy- AND you have to pay tax when you sell- beentheredonethat.

You don't have to buy bonds to manage risk. You can manage risk by 1) Dollar cost averaging and 2) having a long time frame [like 20yrs] and 3) spread the money out in a few ETF's.

I don't like putting money in low return stuff to "Manage risk" unless you are near retirement and need the money soon.

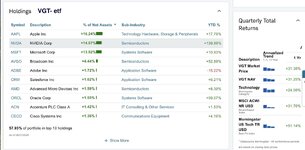

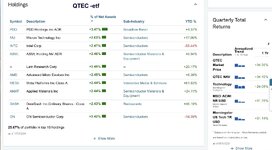

I tell my kids and guys that work for me with a long term time horizon; Split it up into 3-5 ETFs but put a chunk in Tech ETFs. VGT, XLK, FTEC are all 5 star rated by Morningstar. Keep in mind VGT is a bit concentrated with 30% or more in the top 10 companies....I would recommend splitting it up, some in that...and some in a tech ETF that is less concentrated [look up their holdings, pick one concentrated and one with the top holdings no more than 5%]

Then do the same with S&P etf's- concentrated and non concentrated. Plug money in there quarterly and forget it.

Run the numbers; at 19% return you double your money every 4 years. $10,000 in 20 years is over $160,000. ...then in 30 years-BAM. When broad market Tech ETF's are doing that....why mess with individual stocks? Plus ETF's are good tax wise building tax deferred.

The Tech ETF's weren't available when I was younger.....

Of course there is never a guarantee....but you invest in what will work in the future. My bet is tech will be more and more of our lives as time goes by....a pretty good bet.