How many years are left on that 100K?Let’s say I still owe 100k at 2.5% on my house and am starting at $0 in saving at 5% but have an extra $500 a month to put into either. Is there an online calculator or something that kind of shows you the different outcomes? Thanks

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How are people affording these crazy home prices?

- Thread starter lacofdfireman

- Start date

11 yearsHow many years are left on that 100K?

Savings route:

After 11 years you'd have your house paid off and $87K in your savings account

Early payoff:

You'd pay the house off at year 6.75. Taking your P&I ($867) + the $500 and saving that for 4.25 years; you'd have $77K

Not paying off your mortgage at 2.5% yields you 13% more wealth. Obviously this is dependent on rates staying at 5%, if they move up or down that delta grows or falls.

Investment route (same as savings route but you invest in S&P500):

Assuming 10% annual return (historical not factoring in inflation) on your $500/month contribution you'd have $116K when you pay off the house (vs. $87K if you do early payoff at 10%)

All this to say: If you are willing to accept the risk of not paying off your 2.5% mortgage, you will be money far ahead by not making extra payments on that debt.

After 11 years you'd have your house paid off and $87K in your savings account

Early payoff:

You'd pay the house off at year 6.75. Taking your P&I ($867) + the $500 and saving that for 4.25 years; you'd have $77K

Not paying off your mortgage at 2.5% yields you 13% more wealth. Obviously this is dependent on rates staying at 5%, if they move up or down that delta grows or falls.

Investment route (same as savings route but you invest in S&P500):

Assuming 10% annual return (historical not factoring in inflation) on your $500/month contribution you'd have $116K when you pay off the house (vs. $87K if you do early payoff at 10%)

All this to say: If you are willing to accept the risk of not paying off your 2.5% mortgage, you will be money far ahead by not making extra payments on that debt.

11boo

WKR

Pretty sure my first home had an interest rate of 16%. Everyone was paying it back then, and we did not die.

I'd venture to guess people weren't paying $200+ per sq/ft, either.Pretty sure my first home had an interest rate of 16%. Everyone was paying it back then, and we did not die.

They were also making considerably less than they are right now too.I'd venture to guess people weren't paying $200+ per sq/ft, either.

A lot of this stuff is relative.

True. Home prices have significantly outpaced income. Nobody would buy a 400k home with a 16% interest now, thus the lower interest to get people into more expensive homes. I recall my parents paying something like 12-13%. Home sales would come to a halt if that returned now.They were also making considerably less than they are right now too.

A lot of this stuff is relative.

Erussell01

WKR

- Joined

- Jan 30, 2022

- Messages

- 1,305

30 min to the far side of town, 20 min for my wife. It's a nice distance for me to decompress after work and I drive by our hunting permission and the fields we get to goose hunt on the way home. We have lived farther from town on the other side of town and this side is awesome.Sounds like a great place! How far out are you and do have to commute every day?

We are up on a hill so the wind keeps the misquitos at bay. Our piece isn't swampy or anything either so the land is all usable. I have about 18 acres of woods, 4 to 5 acres of field and then a big yard, and garden.

I planted an orchard this spring so hopefully the apples will be producing in a couple years so I can make her very own hard cider.

I put in about 3 acres of food plots in the field and cut in 2 small plots in the woods. Got stands hung and a single trail cut into the woods as a loop so we can take the wheeler through the woods and go from the north end of the property all the way to the county land out back and around to the south end of the property and back up to the house.

We've only been in the house for 3 months and it feels like we have lived here years. People ask how we have gotten so much done... well, I don't sit still much and I want it done for my wife to enjoy

Oh and crack helps get stuff done

Erussell01

WKR

- Joined

- Jan 30, 2022

- Messages

- 1,305

Thanks man. I never thought it would be in the cards. She's a darn keeper and she pushed me to buy the house even though I was super worried.Congrats Erussell!

Thanks! That’s what I was looking for. What is the risk of not paying it off? Like defaulting on the mortgage payment?Savings route:

After 11 years you'd have your house paid off and $87K in your savings account

Early payoff:

You'd pay the house off at year 6.75. Taking your P&I ($867) + the $500 and saving that for 4.25 years; you'd have $77K

Not paying off your mortgage at 2.5% yields you 13% more wealth. Obviously this is dependent on rates staying at 5%, if they move up or down that delta grows or falls.

Investment route (same as savings route but you invest in S&P500):

Assuming 10% annual return (historical not factoring in inflation) on your $500/month contribution you'd have $116K when you pay off the house (vs. $87K if you do early payoff at 10%)

All this to say: If you are willing to accept the risk of not paying off your 2.5% mortgage, you will be money far ahead by not making extra payments on that debt.

CorbLand

WKR

- Joined

- Mar 16, 2016

- Messages

- 9,541

If you do the money market option, near zero. All you are doing is taking the money you would be paying more on your mortgage and putting it in a savings account that is producing more interest than your mortgage is costing you.Thanks! That’s what I was looking for. What is the risk of not paying it off? Like defaulting on the mortgage payment?

If you fall on hard times, you start pulling from that savings to pay the mortgage.

The other major advantage to do this is you keep your cash liquid for other opportunities or needs. You pay 500 more on your mortgage and you can’t really get it back easily. You put it in a savings and you can access it when you need/want.

The current economic/financial market we are in is the best opportunity to make money while taking little to no risk we have seen in the last decade plus. You are talking making five percent on money sitting in the bank.

Last edited:

11boo

WKR

Absolutely not. It was a craptastic modular. I was also making “good” money for the time. 7 to 10 bucks an hour, depending on which job, I had one full time, one part time and army reserve one weekend a month. That was in ski country, so it was like minimum wage lol.I'd venture to guess people weren't paying $200+ per sq/ft, either.

scattergun

WKR

- Joined

- May 30, 2022

- Messages

- 321

CorbLand

WKR

- Joined

- Mar 16, 2016

- Messages

- 9,541

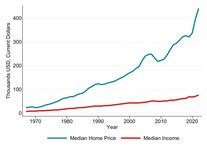

The other tricky that many of these graphs pull, not sure about this one, is that the "median income" has been switched to being calculated off household income. Meaning that starting in about the 90s, it has taken two incomes to meet what they are saying the median income is. If they didnt do this, that bottom line would be going the other direction.Regardless, increases in house pricing have massively outpaced those in income:

View attachment 584444

wind gypsy

"DADDY"

- Joined

- Dec 30, 2014

- Messages

- 13,177

Savings route:

After 11 years you'd have your house paid off and $87K in your savings account

Early payoff:

You'd pay the house off at year 6.75. Taking your P&I ($867) + the $500 and saving that for 4.25 years; you'd have $77K

Not paying off your mortgage at 2.5% yields you 13% more wealth. Obviously this is dependent on rates staying at 5%, if they move up or down that delta grows or falls.

Investment route (same as savings route but you invest in S&P500):

Assuming 10% annual return (historical not factoring in inflation) on your $500/month contribution you'd have $116K when you pay off the house (vs. $87K if you do early payoff at 10%)

All this to say: If you are willing to accept the risk of not paying off your 2.5% mortgage, you will be money far ahead by not making extra payments on that debt.

Another consideration - how much are you getting taxed on interest from a MM or high interest savings account vs is or isn't reducing your taxable income.

If a guy is in a high tax tax bracket and doesn't have tax deductions exceeding the standard deduction the gap between current high interest savings or MM and the mortgage rate can shrink up or disappear.

Last edited:

Tangentally, I read an article recently that referenced the mean and median net worth of the average American. I was surprised to see the mean being 6x+ the median. That is a sad commentray on where we are going as a country, with wealthy becoming increasingly concentrated in the hands of the few.The other tricky that many of these graphs pull, not sure about this one, is that the "median income" has been switched to being calculated off household income. Meaning that starting in about the 90s, it has taken two incomes to meet what they are saying the median income is. If they didnt do this, that bottom line would be going the other direction.

CorbLand

WKR

- Joined

- Mar 16, 2016

- Messages

- 9,541

Out of curiosity, for those that are older than me, when did buying a house start to get advertised as an investment? Has it always been that way or is that something newer?

I was born in 91 and I cant remember a time when someone said you buy a house to live in it. You buy a house to make money is all I have ever heard.

I was born in 91 and I cant remember a time when someone said you buy a house to live in it. You buy a house to make money is all I have ever heard.

Last edited:

11boo

WKR

Out of curiosity, for those that are older than me, when did buying a house start to get advertised as an investment? Has it always been that way or is that something newer?

I was born in 91 and I cant remember a time when someone said you buy a house to live in it. You buy a house to make money is all I have ever heard.

I’m In my 60s. I always thought home ownership was an investment, but I’ve never been upside down on a mortgage. Raised by my grandparents, and they bought a house in their 20s. It just made sense vs renting, I never thought it would work out the way it did. My place has been paid off over 10 years ago,

and it’s far nicer than my first place. It was an investment in my case.

KsRancher

WKR

- Joined

- Jun 6, 2018

- Messages

- 909

This thread got me curious about my place. Bought it in 2014 for $107,000. Its a 1750sq/ft on 2 acres. We added on 400sq/ft and bought another acre beside it. Just looked it up on Zillow and it says it's worth $164,000. And it doesn't know about the 400sq/ft addition or the additional acre. Property taxes are $1600/yr and insurance is $1700/yr. Financed it at 4% for 30yrs when we bought. I know it wasn't the smartest move money wise. But the first 5yrs we put extra on the payment. Took 8yrs off of the end of the loan.

Similar threads

- Replies

- 41

- Views

- 3K

- Replies

- 72

- Views

- 4K

Featured Video

Latest Articles

- Banning Hunting Technology in Idaho?

- Best Gear of the year Rokslide staff edition 2025 Article

- Hunting Gear: Insights from Western Hunting Expo

- Black Diamond Alpine Start Insulated Hoody Review

- Tenacity Firearms with Andrew Whitney

- The Thrill of Moose Hunting with Henry Ferguson

- Final Rise Upland Hand Muff Review

- Kodiak Deer Hunt Round II

- Killing a Timber Giant

- Titanium Suppressor Shootout