Customweld

WKR

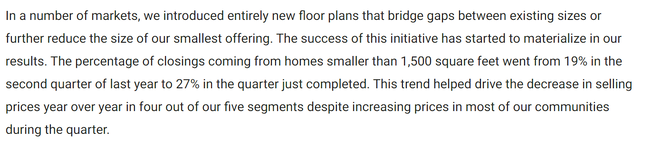

Boy, marketing sure has made fools of us! Have you seen Polaris’s newest utv?Which is really a shame. We seem to have been programmed that if we don’t buy big houses and fancy cars we aren’t a success.

What has replaced the 1955 dream?

in my mind it’s pure envy and materialism.

They keep us mired down in monthly installments, to never realize the true price we pay for everything.