MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 1,553

Falling behind what?

The need to stay afloat, the need to make more than 14% on assets otherwise you’ll just be treading water.

I posted this in the stock traders thread.

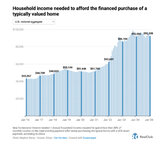

There has been an almost 80% increase in price over five years.

80/5=16 percent increase yoy. From this example 14% is not even cutting it. This is a reflection of over printing, which at this point can’t stop. The last report I saw was showing about $1T needed to be printed every 90 days just to pay interest on our debit.

The S&P has an average roi of 10% throughout its lifetime, but with adjusting for inflation some reports show it’s closer to 6%.

Nasdaq is at 13% over the last ten years.

BTC 10 year total return is 35,815%, 5 years is 942%, and one year is 43%.

Hope that helps explain the falling behind comment.

Sent from my iPhone using Tapatalk