From someone far smarter than me.....

“Could governments seize bitcoin?” That is a common question, and much to the dismay of many, my opinion does not match the typical analysis. I have lost clients due to my honesty regarding crypto. I understand many firmly believe that Bitcoin will one day become the alternative to the USD, but it is unwise to believe that it is a safe haven to park money. I will not sugar-coat the truth, as feelings must be removed from trading. The answer is an astounding YES – governments can seize Bitcoin and all other cryptocurrencies.

To begin, there is much speculation around the founder(s) — Satoshi Nakamoto – who created Bitcoin (BTC) on June 3, 2009. The mystery person or group (or government agency) has been MIA since 2011. Yet 1 million Bitcoins remain in their original account, untouched. His wallet is estimated to be up to $73 billion, and if this is indeed an individual, he or she is one of the top 15 richest people in the world. They have never moved a fraction of a BTC from their account. So, one wallet contains 5% of all mined bitcoin. Will this person or entity perpetually hold?

Only 2.3% of Bitcoin owners own a full Bitcoin, while 74%

own less than 0.01 BTC. Bitcoin was initially a way to remain under the government’s radar, with people using cash to fund their anonymous accounts. The majority no longer use this method and favor platforms that are required by governments to collect and verify all user data.

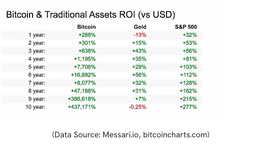

Bitcoin’s price is akin to the problem that existed when the bubble burst in 1966 with mutual funds because they were listed back then. The value can change at a volatility rate of 10x that of the dollar, making it a highly dangerous instrument as a store of wealth. It is solely a trading vehicle until they weigh it and the value is changed.

In 1966, investors bid the mutual funds up beyond net asset value so during the crash, people lost everything when they thought it was a secure investment. The net underlying assets may have dropped 20%, but they paid 20% over the net asset value and then sold at 50% of the net asset value. Many mutual funds crashed 70-90%, whereas the Dow drop was 26.5%. Ever since, mutual funds have no longer been allowed to be listed. You go in and out at net asset value. Bitcoin must change its structure, or it will never become a valid currency with a stable store of value, which is supposed to be the whole point. It is just an asset class of high volatility.

Countries with strong currencies do not want bitcoin in existence. There are numerous ongoing efforts to regulate all cryptocurrencies, as politicians claim people are using it to either bypass taxes or commit crimes. Governments have reached the end of their rope and are actively on the hunt for additional taxes. They will default on all their debts, and the new monetary system they are planning will give them total control.

Governments in Europe and the Middle East prohibited my company from selling their clients REPORTS on bitcoin. We spoke with the regulators and explained we were merely selling a report and not currency, but they threw it all in the same bin. The same exact thing happens when we ship ancient coins as governments consider them currency despite them not being in circulation for numerous lifetimes.

Those who call Bitcoin “digital gold” are onto something, as governments have seized gold in recent history. Herbert Hoover admitted in his “Memoirs” that the investigation that led to the creation of the SEC was on the back of a phone call where he was told it was a conspiracy against his administration to create the stock market crash.

Governments will impose capital controls as they always do. That will mean that they will have no intention of allowing people to buy and sell cryptocurrencies. They will most likely do that as well when it comes to gold and silver. A black market in precious metals may exist with a supply that cannot be increased. They might even seize gold mines.

Governments are allowing cryptos like Bitcoin to exist because they can trace the transactions far better than paper currency. Bitcoin is a trading vehicle and nothing more.