2531usmc

WKR

- Joined

- Apr 5, 2021

- Messages

- 737

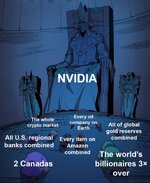

Exxon came out yesterday and said they intend to be the primary energy supplier for the AI data centers. Making the argument that they can provide natural gas powered generation systems much quicker than bringing nuclear online