cowdisciple

WKR

- Joined

- Dec 5, 2023

- Messages

- 385

I have a 401 thru my employer at Edward Jones. Their returns sucks!!! The SPY beats the crap out of them. I have called in several times to try and get all my money put in the SPY. Same answer every time "our policy won't allow that as it's not diversified enough".

Something here doesn't make sense. 401k plans have a menu of investment options set by the plan sponsor (the employer). No one can tell you what to invest in as long as it's on the menu. If there is no S&P 500 index fund on the menu (which would be unusual) than that's the answer. Edward Jones can't set any kind of policy, and if that's what they're telling you, just log in and do it yourself.

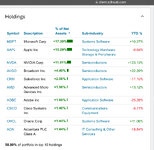

Some very small employers get railroaded pretty hard by plan providers as far as the funds on the menu, so maybe there is no decent option. Every reasonably managed plan should have some kind of passive index option for each major index. I guess if you wanted to post the funds available in the plan you'd get good feedback. If all the options suck (which I have seen) then maybe you don't want to contribute more than needed to capture the ER match, but the tax deferral is still probably worth eating a 1% fee load if you have to.