Whaledriver

WKR

Vxrt is starting to move again. Definite game changing Longshot. Proceed with caution. Whsi for beer money, gambling types.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I threw some extra money at it not knowing anything about the stock. That’s got me feeling pretty good so far today! It’ll probably all come crashing down because I said that.Vxrt is starting to move again. Definite game changing Longshot. Proceed with caution. Whsi for beer money, gambling types.

Gas prices are already increasing...one would think oil would follow. It took a 23 cent jump overnight here.Been almost completely in MM fund for the last month or two, just riding things out with the ~4.5% net yield those are offering right now. I did, however, dip back into PR today. Not a huge position, but with the quarterly dividend cutoff yesterday and with the latest dip in crude price I got in for the lowest share price since beginning of the year. Small bet on this $70/barrel crude price not lasting -- I figure summer seasonality should kick in soon if it's going to, plus it seems like OPEC in the last year has signaled it's not willing to let our administration toy with crude supply for too long without intervening.

They just never came down here, we never saw below $4.20 a gallon this year.Gas prices are already increasing...one would think oil would follow. It took a 23 cent jump overnight here.

Up about $10/share so far.... fingers crossed for doubleI bought 1640 shares of Zions stock yesterday when it hit $19.80 a share.... we will see what happens

Not REIT's but my two divi stocks are ARCC and SAR. Steady and consistent.Anyone in the crowd that's smart on REITs willing to school me on them? I've seen one or two names mentioned here over the months for REITs that people are holding, but how have those worked out for you and how do you see the divided yields holding up as the prices fall?

I'm paying attention to them, but the more I research the more confusing it gets with floats and debt maturity dates and all kinds of terminology that seems like REITs have their own language.

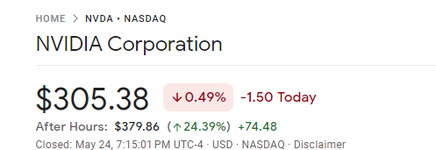

Good on ya.i have calls on NVDA

wish i'd done a lot more

You and I are in the exact same boat. You know it’s all going to fall apart but the question is whenGood on ya.

This stock was on my watch list for a few months and I was close to buying when it got to about $110/sh just recently (yes, recently) , but I just could not pull the trigger given where I think we are headed with our print money until we implode economy. OTOH, what the heck do I know? Maybe we can print ourselves to wealth.

No need for me to guess how their earnings report looked given this.

Eddie

View attachment 557298

MMFs paying over 4.5% after expenses. I'm sitting almost completely on the sidelines in MMFs right now as I still expect things to get worse before they get better. That said, NVDA is a clear example that there is still money to be made out there, but its a risk-reward calculation.You and I are in the exact same boat. You know it’s all going to fall apart but the question is when

Wouldn't consider myself smart or expert on the matter, but I have held a position in $O for over 10 years and is my most consistent dividend payer, so I can speak on that stock. Like with all investments, its depends what you want out of it, dividend/growth/mix of both. For me REITS are mostly income generating/value retention, so I mainly hold O for monthly dividends than compared to other popular monthly dividend paying stock like QYLD as my holdings in O has also gained value and the dividend has also increased $0.10/share over that time frame. I do hold other REITS (i.e. STAG) in much in smaller amounts compared to my position in O and that just because O rents to various businesses so the variety is caked in and I can sell covered calls at decent enough premium on my position to boost the income on it. I like that their contracts are triple net leased and with long term tenants which I believe helps limits risk somewhat as its passed on to their tenant.Anyone in the crowd that's smart on REITs willing to school me on them? I've seen one or two names mentioned here over the months for REITs that people are holding, but how have those worked out for you and how do you see the divided yields holding up as the prices fall?

I'm paying attention to them, but the more I research the more confusing it gets with floats and debt maturity dates and all kinds of terminology that seems like REITs have their own language.

I don't know much about REITs, but given what I've been hearing about massive over-valuations in commercial real estate and the potential for that being a bubble that will pop soon, I'd be careful about getting into any that are heavy in commercial. But again, I know next to nothing about them other than the summary on Nerd Wallet that I read, so take that with a large grain...Anyone in the crowd that's smart on REITs willing to school me on them? I've seen one or two names mentioned here over the months for REITs that people are holding, but how have those worked out for you and how do you see the divided yields holding up as the prices fall?

I'm paying attention to them, but the more I research the more confusing it gets with floats and debt maturity dates and all kinds of terminology that seems like REITs have their own language.