mitchamafied

FNG

CEI got a bit closer to getting me out of a deep hole.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Wow, that is unbelievable, I'd tell VG to ****-off immediately. Leave them and find another trading platform. The SEC/TDA cost me a ton of money pulling this shit last year. I have a few dead OTCs now that may never recover due to zero volume.I got an email from vanguard this morning stating as of 4/28 you will no longer be able to buy OTC stocks with vanguard. What a crock of BS.

I need 1.84 to break even. Probably the dumbest play I've made in the past year.CEI got a bit closer to getting me out of a deep hole.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/BNYTEJPRY5IVXPCSHHNHSJFAIU.jpg)

Literally just sold the other day after it broke even. Was hoping to catch it at a lower price.... Just my luck though....GTE released some good news yesterday. Will likely see that climb in the next few weeks

I learned the hard way its better to dollar cost average than sell and try to get a lower price.Literally just sold the other day after it broke even. Was hoping to catch it at a lower price.... Just my luck though....

I most certainly learned this lesson in CDEV. Figured I could hop in at a lower price which never cameI learned the hard way its better to dollar cost average than sell and try to get a lower price.

Thanks man, still holding my friend.Took profits on a portion of my GTE holdings yesterday, I won't quite be buying a boat with it like my man @Broomd but a huge tip of the hat to him for giving me the confidence I needed to ride out some stormy days on that ship. Any thoughts on a revised exit plan for yourself with the current state of O&G?

I just flat sold CDEV and BORR way to early.I most certainly learned this lesson in CDEV. Figured I could hop in at a lower price which never came

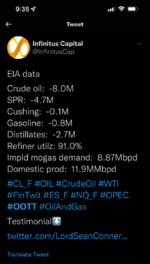

In other news, Holy Sh!t...what a draw. And the SPR is dry, thanks, Brandon.

I'm thinking there will be a sell off around the $10 level so if I were inclined to do so I'd prob put in an order for around $9.80ish Remember, pigs get fed, hogs get slaughteredHow long would you “buy and hold” guys hang on to CDEV?

Probably not bad advice. I was thinking many will be camping at $9.99.I'm thinking there will be a sell off around the $10 level so if I were inclined to do so I'd prob put in an order for around $9.80ish Remember, pigs get fed, hogs get slaughtered