You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Montana is #1 (well actually #50)

- Thread starter mtwarden

- Start date

TaperPin

WKR

- Joined

- Jul 12, 2023

- Messages

- 3,229

When a good portion of highly paid workers across the country can make a living anywhere, the best states will be overtaken by non residents.

Most of my clients were independently wealthy, often from out of state, and 90% didn’t give a rats ass about schools, the other things that make up healthy well functioning town, or anything other than what they could get for free, and I do a little happy dance every time one of them drops dead.

Most of my clients were independently wealthy, often from out of state, and 90% didn’t give a rats ass about schools, the other things that make up healthy well functioning town, or anything other than what they could get for free, and I do a little happy dance every time one of them drops dead.

derrick454@

FNG

- Joined

- Dec 3, 2022

- Messages

- 90

They want it un-affordable to put us tiny highrises in the dam city. It’s part of the plan.

It’s dang tough to make it as the middle class but I know there are people way worse off so I try not to complain to much….I see Detroit is affordable.

Sent from my iPhone using Tapatalk

It’s dang tough to make it as the middle class but I know there are people way worse off so I try not to complain to much….I see Detroit is affordable.

Sent from my iPhone using Tapatalk

Jimmy

WKR

Who is to blame the people selling or the people buying?

Fujicon

FNG

- Joined

- Feb 26, 2024

- Messages

- 93

All about demand. "Westward ho" is still a thing. And specific location is far more telling than just looking at state averages. For example, last time I checked per-capita income levels between Portland and Seattle (ber fed Bureau of Economic Analysis), people in Seattle were 47% higher than Portland. That's a helluva difference in affordability since living in Seattle is not 47% higher cost.

- Thread Starter

- #6

Who is to blame the people selling or the people buying?

I don't mind folks selling their property; just sell it to someone who lives here already

The $hit of it there is no financial advantage that your home doubled in value in five years, unless you want to leave the state. Just the opposite, the state has its' hand out to insure they get double their property tax

Montana's like the girl you dated in college that was out of your league........she sure is pretty, but hard to hold on to.

When a good portion of highly paid workers across the country can make a living anywhere, the best states will be overtaken by non residents.

Most of my clients were independently wealthy, often from out of state, and 90% didn’t give a rats ass about schools, the other things that make up healthy well functioning town, or anything other than what they could get for free, and I do a little happy dance every time one of them drops dead.

Are you an escort?

Pharmseller

WKR

“Independently wealthy” has a nice ring to it.

P

P

Idaho is only 2 behind you.... I just got my PERSI letter Monday. Needless to say, if I actually retired with my goverment job, my wife and I will have to move to retire somewhere. My retirement won't be able to allow us to live here.

Have actually looked hard at moving to MT, been looking for work but the pay is killing me.

Have actually looked hard at moving to MT, been looking for work but the pay is killing me.

*zap*

WKR

the more things cost the more tax the government gets.

buffybr

Lil-Rokslider

My house is about 5 miles outside of Bozangles. The house was a 1900 sf tri-level on a 3 acre hillside that I bought in 1978 for $75,000. The 7 acres behind it was also available for $4,000, which I also bought. That 7 acres is completely landlocked, with the only access to it from my driveway. The lower acre of that parcel has about a 10% slope, then the next 6 acres are up and over a hillside that is too steep for a 4wd pickup.

My last property tax bill listed the "market value" of that 7 acres as $421,949 and an annual property tax of $1,050. That's a 10,549% increase in the "market value" of that inaccessible raw land!

Today only the very wealthy can afford to move to Montana.

My last property tax bill listed the "market value" of that 7 acres as $421,949 and an annual property tax of $1,050. That's a 10,549% increase in the "market value" of that inaccessible raw land!

Today only the very wealthy can afford to move to Montana.

ThunderJack49

Lil-Rokslider

I've been building homes in montana off and on for the last ten years and a majority of them are either high end custom homes that are primarily vacation homes. Sometimes they are a primary residence but often then the folks are just moving to montana to "try things out". I used to build spec homes for developers but even those are unaffordable to most residents.

Who is to blame the people selling or the people buying?

If there were only buyers and sellers this might be valid, but you've got hedge fund builders and investors (a new development near me was built by BlackRock) doing things to local economies via overbuilding and densifying that negatively affect the rest of the world. Sure, my house value goes up, but not enough to even get close to incentivize me to sell because i can afford nothing else in the area.

It is yet again the Tragedy of the Commons. Apparently we can't learn...

Last edited:

Yoder

WKR

- Joined

- Jan 12, 2021

- Messages

- 1,670

Kevin Costner.Who is to blame the people selling or the people buying?

- Thread Starter

- #16

ORJoe

Lil-Rokslider

Both are reacting naturally to the circumstance they are in.Who is to blame the people selling or the people buying?

I'm a Californian who just sold my house for a cool mil, but I need a new house. Should I buy another little house in California, or should I buy a bigger house in Montana and have half a mil left over?

I'm a Montanan who is done with my house and want to sell it. Maybe I'm trading the house for an RV to travel the states, maybe house building is my job and I like food. Doesn't matter. Should I sell to someone with 1/4 mil and buy an RV, or a Californian with 1/2 mil and also fill the tank on that RV? Maybe I want to buy another house here and will be competing against a Californian with more money.

Repeat over time and distance and here we are.

Every so often someone will leave money on the table to sell specifically to a local. That's basically charity, don't rely on it. Especially after one recipient of a generous house sale flips it and runs.

Fujicon

FNG

- Joined

- Feb 26, 2024

- Messages

- 93

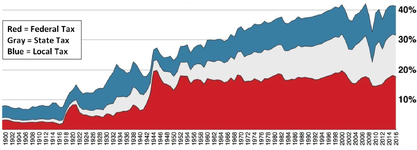

Indeed. The amount of our income getting gobbled up by federal, state, and local taxes is terrible. No agency "officially" tracks this (why would they want to report on their own greed?), but this estimate showing how total tax burden has changed from 1900 to 2016 is telling:the more things cost the more tax the government gets.

And what are we getting for it? Are we getting better service with all that tax growth? Yeah, right. Let me provide a couple examples of what we are NOT getting for all that extra tax burden...

In the Portland-Vancouver area there were 12 new bridges built across the Willamette and Columbia Rivers during the 23 years between 1908 and 1931. Advance the clock a century and compare to today. Takes them more than 20 years just to "plan" for an I-5 bridge replacement over the Columbia River, and their expected cost is 30 times the original bridge expense (that's accounting for inflation). And on top of our taxes, they want to charge us tolls to use that bridge. Brilliant. Another example is parks. Used to be we didn't have to pay to use parks. Now we have to pay fees to visit federal, state, and even some local parks. The examples are endless. And the above graph only concerns taxes; it doesn't include all the charges, fees, tolls, etc. we now have to pay. It's crazy ridiculous how expensive government has become.

So if all that increased tax burden is not producing better services, what are we paying for? If any of you have an answer to that golden question I'd sure like to hear the answer.

- Thread Starter

- #19

There will definitely be some folks in Montana (because they bought their home 20+ years ago) that simply won't be able to pay the property taxes, maybe already is.

Not sure if there other states, but California "freezes" your appraised value at the time you purchase your home—this is what they calculate your taxes with and as along as you continue to reside in it. This only applies to residents of the state and the home has to be your primary place of abode- not your second, third home.

We had a similar initiative come up last legislative cycle and evidently it didn't have required number of signatures—I never saw sign up sheets, but would gladly have signed. Local, county and state officials and legislators were up in arms about it and vowed to fight it in the courts, which told me the people that drafted the initiative were definitely on the right track.

Not sure if there other states, but California "freezes" your appraised value at the time you purchase your home—this is what they calculate your taxes with and as along as you continue to reside in it. This only applies to residents of the state and the home has to be your primary place of abode- not your second, third home.

We had a similar initiative come up last legislative cycle and evidently it didn't have required number of signatures—I never saw sign up sheets, but would gladly have signed. Local, county and state officials and legislators were up in arms about it and vowed to fight it in the courts, which told me the people that drafted the initiative were definitely on the right track.

Similar threads

- Replies

- 0

- Views

- 407

- Replies

- 0

- Views

- 645

- Replies

- 0

- Views

- 369

- Replies

- 0

- Views

- 328

Featured Video

Stats

Latest Articles

-

WE WON!

-

Mule Deer Rut Update & Buck Story

-

Sitka Gear HyperDown Sleeping Bag Review

-

TT#42 Mark Denham with Outdoorsmans history and innovations.

-

Kryptek Traverse Merino Review

-

First Lite 308 Pant Review

-

Argali Selway 6P Tent Review

-

AGC Kobuk 2800 Backpack Review

-

Hunting The Leaf-off Window

-

TT#41 Jordan Budd’s Tips on Finding and Killing the Big One