Ucsdryder

Modern Fuddster

- Joined

- Jan 24, 2015

- Messages

- 7,534

The mortgage thread got me thinking about auto loans. Dave Ramsey has been a hot topic and he talks about vehicles keeping America poor. My wife and I have talked about a new vehicle a few times, but dang…

Obviously these numbers are made up, but realistic. They don’t take into consideration increased fees for registration and insurance on a new vehicles, but I still think it paints a picture. Of course, everyone needs a vehicle so it’s not quite as simple.

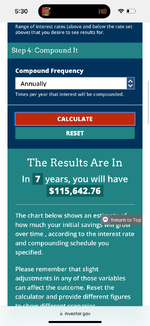

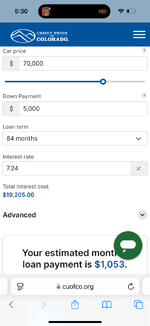

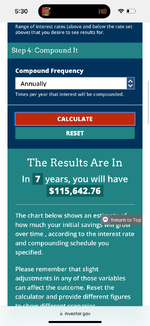

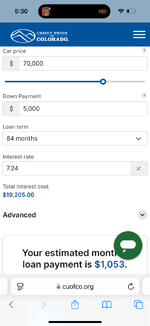

Based on the screen shots below. If a potential buyer invests the down payment, plus the monthly payment over 84 months, it would result in $115,000 with an 8% return. If that potential buyer buys a 70k Tahoe, after paying their last payment they have a $25,000 Tahoe.

Curious how everyone balances this…

Obviously these numbers are made up, but realistic. They don’t take into consideration increased fees for registration and insurance on a new vehicles, but I still think it paints a picture. Of course, everyone needs a vehicle so it’s not quite as simple.

Based on the screen shots below. If a potential buyer invests the down payment, plus the monthly payment over 84 months, it would result in $115,000 with an 8% return. If that potential buyer buys a 70k Tahoe, after paying their last payment they have a $25,000 Tahoe.

Curious how everyone balances this…