I have only recently realized that this makes financial sense, so still need to install a system. My plan is a DIY install. Here are the key factors:

- Grid tie system, no batteries. Essentially a mini solar power plant on your roof.

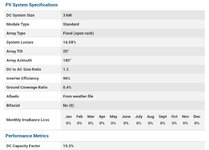

- 3kW system in my area yields about 4600 kWh per https://pvwatts.nrel.gov/

- Assume average energy prices for my area based on https://www.bls.gov/regions/midwest/data/averageenergyprices_selectedareas_table.htm

- Assume a 3kW system materials costs $6000, and maybe another $1000 for added costs (permits, electrician inspection, etc.). I bet this could get lower if one spends time shopping around.

- Assume electricity rates increase 2% each year (I'm uncertain on this one).

Assume S&P 500 grows 7% each year (also uncertain)

KEY ASSUMPTION - for an apples-to-apples comparison, any savings not spent on electricity gets invested in the stock market. Treat this like a business, not a pass for increasing consumerism once the system gets paid off.

- Each state has different regulations on power production. Some might only reimburse what you generate, others may buy back your excess. It depends.

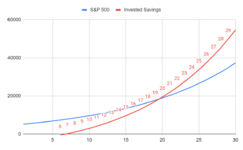

Results: With the 30% tax credit through 2032, and the above listed assumptions for a DIYer, it would take me about 7 years to pay off the initial investment. The plot below shows 'Invested Savings' meaning what is not spent on electricity gets invested and grows at the same rate as the stock market. Anything after 20 years yields better returns in my situation (and assumptions). They say panels are generally warrantied for 25 years, but should last longer.

This is just a base cost for minimal usage. Say I add more panels, I could sell that back into the grid and get better long term returns. This doesn't consider the externalities. How do we put a price on preventing a solar farm in winter wildlife range?

SolarDIY reddit wiki page has some good resources to consider:

https://www.reddit.com/r/SolarDIY/wiki/index/

Turns out I can't upload spreadsheets, but plopping in a pdf of the sheet.

View attachment 541610