Fortunately for MSTY, MSTR is up 5.82% today. Saylor has stopped hitting the ATM on MSTR common stock and is raising $$$$ with his perpetual preferreds: STRF, STRC, STRK, STRD, and STRE and is using the money to buy more BTC. This stops the dilution of the common stock and increases the multiple-to-net-asset-value (BTC).Speaking of MSTY....if BTC continues its slide, MSTY at zero, or close, is not impossible IMHO.

Eddie

P.S. I wrote this yesterday and didn't click "Post Reply." Ugh!

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Rokslide Stock Traders Thread

- Thread starter Kilboars

- Start date

HuntHarder

WKR

Lots of buying opportunity right now. = I am losing my ass, please join in my misery.This thread has gotten a little quiet lately.

I haven’t even looked at my portfolio in 2 weeks. Part of me wants to throw money in and part of me wants to put it under my mattress.

HuntHarder

WKR

Anyone else read the article talking about MSTR being upside down on Assets vs. Debt? I am thankful my MSTY experiment was only a 2 month slip of the mind.

There is potentially a few steps to this question but I'll give you the first one:What's the process to sell stock?

Say $15,000.00?

My Edward Jones guy says there is a fee, and I'd pay capital gains?

Can I calculate the capital gain and any other fees? Curious to see what I would come out with after.

1) If the EJ guy makes a dime off you, then send him packing.

Good luck,

Eddie

MSTY at zero ?Speaking of MSTY....if BTC continues its slide, MSTY at zero, or close, is not impossible IMHO.

Eddie

P.S. I wrote this yesterday and didn't click "Post Reply." Ugh!

Don’t put that evil on me Ricky Bobby.

HuntHarder

WKR

Very situation dependant. If this is just a personal broker account, you have either short term capital gains or long term. If you have owned the stock for less than a year, it will be short term and taxed at your ordinary income tax rate. If you have owned it longer than a year, it will be long term and a lower percentage. Long term preferential tax is either 0%, 15% or 20%, depending on your income level. Most fall into the 15% category on Long term.What's the process to sell stock?

Say $15,000.00?

My Edward Jones guy says there is a fee, and I'd pay capital gains?

Can I calculate the capital gain and any other fees? Curious to see what I would come out with after.

As far as your EJ guy's fees, that depends on your agreement. If you pay a fee on anything othet than the actual interest $ gained, I'd send him packing as Eddie said.

Please post the article. MSTR's total debt is currently 8.2B. The value of their assets (650k BTC) is currently 76.3B.Anyone else read the article talking about MSTR being upside down on Assets vs. Debt? I am thankful my MSTY experiment was only a 2 month slip of the mind.

MicroStrategy (MSTR) is a publicly traded company and as such, it can only be entirely "liquidated" through formal corporate procedures like a

shareholder vote to dissolve the company or through bankruptcy proceedings. A forced liquidation of its Bitcoin (BTC) holdings, in a margin-call sense, is highly unlikely under the company's current debt structure and Michael Saylor's controlling voting power.

Liquidation Scenarios

- Forced Sale of Bitcoin (Margin Call): The risk of a traditional, loan-based margin call resulting in forced BTC liquidation is minimal. Most of MicroStrategy's debt is in the form of long-term convertible notes, which do not have a specific BTC price trigger that would automatically force a sale. The company holds a large amount of unencumbered Bitcoin and can raise new capital if needed.

- Inability to Repay Debt at Maturity: The debt obligations mature in increments over the next decade, with the main maturities beginning around 2027-2028. If the price of Bitcoin were to experience a prolonged and extreme decline (well below current levels) and stay low for years, the company could face challenges in refinancing or paying back the principal when due. In such a scenario, they might choose to sell some Bitcoin, issue more shares (dilution), or potentially face a default situation.

- Corporate Bankruptcy: This is the most direct path to the company's full liquidation. However, Michael Saylor, as executive chairman, holds significant voting power (46.8%), making a shareholder-initiated dissolution or an involuntary bankruptcy highly unlikely in the near term.

- Voluntary Action: The company's stated strategy under Saylor is to continue accumulating Bitcoin and never sell its core holdings, viewing it as a long-term strategic asset. A voluntary, full liquidation is contrary to their publicly announced business model.

In short, while not impossible in extreme, sustained bear-market conditions over several years, the current structure is designed to avoid forced liquidation of its core Bitcoin assets

HuntHarder

WKR

Idaboy

WKR

- Joined

- Oct 22, 2017

- Messages

- 933

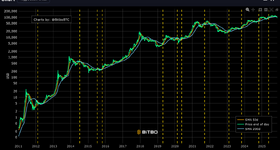

I know there is a separate BTC thread, but seems like BTC and it's proxies are crossing below major moving averages.

BBob

WKR

A lot of things across the market as a whole are under the 50SMA at the moment, not just BTC.I know there is a separate BTC thread, but seems like BTC and it's proxies are crossing below major moving averages.

Idaboy

WKR

- Joined

- Oct 22, 2017

- Messages

- 933

I get that, but it does not seem to be behaving like any kind of hedge at the moment..A lot of things across the market as a whole are under the 50SMA at the moment, not just BTC.

Attachments

KsRancher

WKR

- Joined

- Jun 6, 2018

- Messages

- 909

That's my thought also. Not sure what its a hedge against.I get that, but it does not seem to be behaving like any kind of hedge at the moment..

Kimber7man

WKR

That's like malpractice. 50-60 individual stocks??? wowWe just fired a CFP and took my wife's portfolio back over from him and put all the funds back in Fidelity. He had like 50-60 individual stocks in her traditional and Roth IRA and only a couple of mutual funds. I'm harvesting some gains and stopping some losses on some of the dogs. The goal is to put most of it back into low cost mutual funds and setting aside some cash if/when the bubble pops.

Haha and I know. When it was paying out those ridiculous DIV, I knew it would last, but I also rolled the MSTY dice as I wanted a little action in the world of BTC. If BTC can get back to above $120k before MSTY grenades, there is hope.MSTY at zero ?

Don’t put that evil on me Ricky Bobby.

I also bought STRK. Its 8% payout is safer than the MSTY DIV, but both being worth zero, or close, is not that unlikely. As with MSTY, I wanted a little BTC exposure w/o dealing with cold wallets, and losing passwords and all the other crap associated with BTC. STRK is just below my buy price so I might be a few more shares since the 8% payout is worth the risk of default. I ain't touching MSTY no matter cheap.

Eddie

Haha and I know. When it was paying out those ridiculous DIV, I knew it would last, but I also rolled the MSTY dice as I wanted a little action in the world of BTC. If BTC can get back to above $120k before MSTY grenades, there is hope.

I also bought STRK. Its 8% payout is safer than the MSTY DIV, but both being worth zero, or close, is not that unlikely. As with MSTY, I wanted a little BTC exposure w/o dealing with cold wallets, and losing passwords and all the other crap associated with BTC. STRK is just below my buy price so I might be a few more shares since the 8% payout is worth the risk of default. I ain't touching MSTY no matter cheap.

Eddie

I am unfortunately stuck holding the bag on MSTY, just hope it can survive crypto winter or I’ll have a decent sized L on my hands. Rough rough month.

2531usmc

WKR

- Joined

- Apr 5, 2021

- Messages

- 736

Proxy for the NASDAQ…I know there is a separate BTC thread, but seems like BTC and it's proxies are crossing below major moving averages.

LFC911

WKR

Yep between her regular and roth IRA, so more like 25-30 in each fund. He did have some winners but a lot were dogs. We tried him for a year and 1% and he was making 5% in the market when i was making 12% in my 401k at work. Lesson learned.That's like malpractice. 50-60 individual stocks??? wow

Similar threads

- Replies

- 91

- Views

- 6K

- Replies

- 5

- Views

- 862

- Replies

- 2

- Views

- 457

Featured Video

Latest Articles

- How Old Was He Really? Big Buck Hunters Talk Age vs. Score

- Banning Hunting Technology in Idaho?

- Best Gear of the year Rokslide staff edition 2025 Article

- Hunting Gear: Insights from Western Hunting Expo

- Black Diamond Alpine Start Insulated Hoody Review

- Tenacity Firearms with Andrew Whitney

- The Thrill of Moose Hunting with Henry Ferguson

- Final Rise Upland Hand Muff Review

- Kodiak Deer Hunt Round II

- Killing a Timber Giant