Question for you guys, Im not well versed on the stock market. I dont have much time to follow it closely.

A few years ago I moved my 401k contributions from a Lifepath retirement fund to %100 BlueChip (not the BlueChip) heavy in Nvidia, maxed my 401k contributions out during the last tech slump (2023) Which has done alright still at a 4% positive when compared to the last dip a few weeks ago.

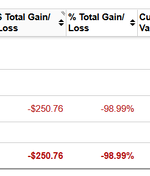

I have some At&t stock that im probably still in the red on. I dont mind sitting on this as At&t have made some changes that have helped the stock prices. The dividend checks are still decent.

Should I pull out of savings to buy and/or start a Roth? Or use the At&t I have and start paying more attention to the markets?

I do work for a utility company and can buy discounted stock but im not sold on the futures with my local environmental climate.

I dont think the Tarrifs are going away anytime but greatly reduced, any USA based companies worth looking into?

Tesla seems good to buy and sell short term, US software companies seem safe for now. Grocery chains have done will in slumps including Amazon, the Tariffs should reduce those gains some.