CorbLand

WKR

- Joined

- Mar 16, 2016

- Messages

- 9,456

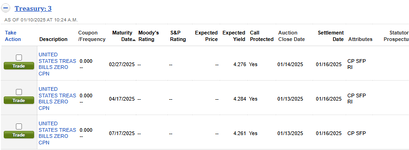

Theres a few Tbills that are roughly that same return and you wouldnt have to pay state taxes on the gains from them. If you have Fidelity, it is as simple as opening a brokerage account, putting the money into it and buying them.Ok so I was only partially right, you can add money to them at any time but if you pull any out before maturity you lose 3 months of interest. We opened them at 5.25%, right now they’re offering 4.25%, have another month to decide whether to move it or leave it there

Locking some money up at 4.25% for a bit might not be a bad play. I THINK most rates are going to hover right around there and if they do move, it will be down.

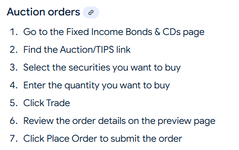

Here is step by step on how to purchase them. The Fixed Income, Bonds and CDs link can be found in the News & Research tab.

Just another option for you and others. Depending on how much money you are talking, that tax savings can be significant.

.

.