But I still don’t think this is a widespread financial meltdown.

What clown posted this?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

But I still don’t think this is a widespread financial meltdown.

The short term reaction is always bigger than the actual impacts.What clown posted this?Since then Moody’s has downgraded the entire U.S. banking system, Credit Suisse is floundering, and the Dow is down 520 points this morning.

Question for the experts on here. Thoughts on acquiring gold or silver as a safety net. It’s constantly pushed on talk radio, but I am skeptical of ads in general. I guess at the end of the day, what would be better to keep in a safe at home, cash or precious metal, or both?

I’m having a hard time with O&G right now personally. Assuming this is a recession, O&G should still go down from here. But there is a lot to be said for “market movers” and “price manipulation” and politics and geopolitics and all kinds of other major influences that operate outside fundamentals. Part of me wants to buy this dip though, but I’m holding what I got for now.O and G is getting spanked! Man I wish I sold 6 months ago. What gives?

GTE and MRO owner

Same here man. I played the gold and silver game in 2020, and boy it did NOT pan out. When the shit hits the fan the paper gold market is still just a stock market, and people sell everything when the margin calls.I’m no expert but I think I’d invest in land before invested in gold.

Sent from my iPhone using Tapatalk

I’m no expert but I think I’d invest in land before invested in gold.

Sent from my iPhone using Tapatalk

But where do you really exchange gold for cash. The local pawn shop or jewelry store? And they give you 80 cents on the dollarCash is never a bad idea. If the power goes out for multiple days, you can still buy things (in theory). I personally do not have gold but it can be exchanged for currency most places. I guess it depends on why you buy it and what purpose does owning gold serve for you.

Most reputable online buyers will pay a 1-3% premium over spot for AGE's and AGB's, but this defeats the purpose of why one should hold physical Au.But where do you really exchange gold for cash. The local pawn shop or jewelry store? And they give you 80 cents on the dollar

I get it that it’s the only “real” money in a world overflowing with fiat currencies, but how do you convert it into something useful in the real world?

With this line of question, I think you might be crossing over into the prepper mindset. When SHTF actually happens, cash or gold won't do anyone much good. You need useful stuff that will sustain & protect you along with stuff others will want / need to barter with. Food, ammo, etc. But that's a deep rabbit hole that is best served on a thread separate from this one.I get it that it’s the only “real” money in a world overflowing with fiat currencies, but how do you convert it into something useful in the real world?

For SVB, the sheep who pulled their deposits out of the bank were the problem. Absent that fear, that bank is still in business today.For those banks who were not leveraged properly folks pulling funds out of the bank will only compound the problem.

How?No I'm staying that if you have over $250,000 it is easy to keep it in 1 bank and still have it covered by FDIC insurance if you are a normal person.

It is much harder to keep it covered if you are a corporation.

If you are a married couple it is easy to have FDIC insurance covering 1,000,000 in funds. Of course it's difficult to accumulate that much.

Scroll back to post 11,083. I posted the FDIC EIDE calculator. I can use this calculator to create hypotheticals or look at your current accounts to view your coverage.How?

You can also find a bank that participates in CDARS. Basically CD sharing. The money has to be put in CDs (which don't look too bad at the moment). But "your" bank will have you sign some paperwork and make a deposit. Then they will spread the funds out on the CDARS system making sure accounts are at separate banks. This system shares deposits back and forth between banks so your bank can still show you have "access" to your funds, but they are spread across multiple banks, your bank just accepted some of the other banks deposits on a swap to balance out the funds of yours they sent out.How?

Most reputable online buyers will pay a 1-3% premium over spot for AGE's and AGB's, but this defeats the purpose of why one should hold physical Au.

LCS (Local Coin Shop) should be at spot and maybe a little over spot for the above.

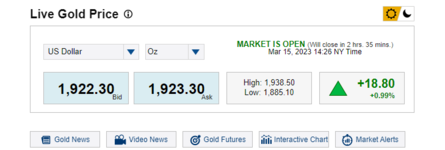

I'm going to ask my LCS this week and will report back as I am curious. I can say for certain it will be above 80% of spot (which is up nicely today, btw). Cooled off from today's high but still nicely up for the day.

Eddie

View attachment 530624

This is interesting. But doesn’t this mean the POD accounts are only insured if you die (and are not insured if the bank fails while you’re alive)?Scroll back to post 11,083. I posted the FDIC EIDE calculator. I can use this calculator to create hypotheticals or look at your current accounts to view your coverage.

The jist of it is, paid on death beneficiaries, and joint accounts help you.

For example in my hypothetical world I have the following accounts all at the Bank I manage:

Acct #1. Joint with my wife and I with 500k no beneficiaries

Acct#2. Personal account for me with son #1 as paid on death beneficiary. $300,000 balance

Acct#3. Personal. Acct. For me with Daughter as POD beneficiary $300,000 balance.

Acct#4. Personal acct. For my wife with Son #2 as POD beneficiary. $300,000 balance

In this example my wife and I have a total of $1,400,000 at one bank. Of that $1,250,000 is insured and $150,000 is uninsured. This is because the accounts with paid on death incorporate my children on the account. So even if they don't have control of the account there is insurance to cover the funds that would flow to them upon my death.

The calculator is a great tool to play with as you can account for business accounts, personal accounts, trust accounts, etc and see what can be covered.

By sheep I think you mean start ups pulling money to make payroll. Particularly the ones running a deficit. That's the underlining piece of this people are missing. A lot of companies are likely running on fumes at this point.For SVB, the sheep who pulled their deposits out of the bank were the problem. Absent that fear, that bank is still in business today.

I personally think that buying by quality banks stocks after this downturn is a smart move.

I've got the land covered. I am just thinking along the lines of a safety net. If you wanted a rainy day fund/safety net that you can actually see and touch, which would be the best?