Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Rokslide Stock Traders Thread

- Thread starter Kilboars

- Start date

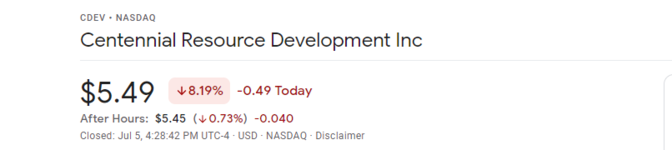

I did it at 5.55. Also, BORR. Back in at 3.88 today.Glad to post I held off on this, but it's starting to get to a price that might be worth a buy.

Eddie

View attachment 425733

DiabeticKripple

WKR

I bought Suncor. Massive company not going anywhere and with their CEO quitting they should be on the up.What are you guys buying to hold long-term at these sale price’s?

Sent from my iPhone using Tapatalk

Im going to switch my oil portfolio from service companies to producers. A bit more stability.

ramsdude47

WKR

Alcohol should fare well if we dive into the deep recession it looks like we could.

Clarkdale17

Lil-Rokslider

No mention of the new president situation

DiabeticKripple

WKR

pretty much all good news, with the exception of an exploration well that hit water.

No mention of the new president situation

No debt is huge going into a global recession. I hope these guys do well as they are local to me.

go_deep

dWKR

- Joined

- Jan 7, 2021

- Messages

- 3,049

9.1% inflation, up to 8 more interest rate hikes, zero desire to push for energy independence that isn't electric, hold on ladies and gentlemen.

safarihunter

FNG

- Joined

- Feb 11, 2021

- Messages

- 88

Clarification: Zero desire to push for energy independence that isn't wind or solar. If there was a push for getting more nuclear plants up and running (to reduce usage of coal and LNG) I'd be all for that.9.1% inflation, up to 8 more interest rate hikes, zero desire to push for energy independence that isn't electric, hold on ladies and gentlemen.

go_deep

dWKR

- Joined

- Jan 7, 2021

- Messages

- 3,049

We all have to stand for something, even if it doesn't make sense.Clarification: Zero desire to push for energy independence that isn't wind or solar. If there was a push for getting more nuclear plants up and running (to reduce usage of coal and LNG) I'd be all for that.

aftriathlete

WKR

- Joined

- Jan 18, 2022

- Messages

- 477

I made a bet on gold stocks this week, we’ll see how that plays out. I know they could potentially fall further, but I also recognize that GDX and GDXJ are deep into extreme oversold territory already, so I put a bet on GDXJ as it looks like gold is finding support at $1700 right now and the rate hikes are priced in to the market already. YMMV. Sticking with my OXY stock right now as well as I can’t imagine Warren Buffett doesn’t know what he’s doing.

Those crazy anti science energy policies are working great for Europe now . Doubling down on stupidWe all have to stand for something, even if it doesn't make sense.

String&stick

WKR

- Joined

- Jan 16, 2018

- Messages

- 1,062

.75 rate hike is priced in. . . But wait and see what happens when the fed decides to go for a full 1.00 hike at the end of the month, that will get some attention!I made a bet on gold stocks this week, we’ll see how that plays out. I know they could potentially fall further, but I also recognize that GDX and GDXJ are deep into extreme oversold territory already, so I put a bet on GDXJ as it looks like gold is finding support at $1700 right now and the rate hikes are priced in to the market already. YMMV. Sticking with my OXY stock right now as well as I can’t imagine Warren Buffett doesn’t know what he’s doing.

As long as unemployment remains low they are going to hammer that interest rate bell. I don't think they are even weighing the fact that their actions take a minimum of 3-4 months to start truly showing up, they just want that inflation number down!

Broomd

WKR

Yep just read about some states warning on rolling blackouts/brownouts and that charging EV cars may not even be possible. Like everything else in this clown world no one has any patience to do things the right way. EV will have it's place when the tech is there and it's reliable.Those crazy anti science energy policies are working great for Europe now . Doubling down on stupid

Oil and natty gas are the lifeblood of every economy and those who eschewed it are now dead in the water.

Last edited:

USNvet

FNG

- Joined

- Jul 12, 2022

- Messages

- 5

I'm new to this forum, and just saw this thread on stocks. The first posts were talking about the 2020 Covid crash, and buying bargain stocks during that market dip. That crash is now over with and has since recovered, but now we have the next bargain hunting session upon us.

I've used high dividend paying stocks to add to my retirement income since retiring a few years early in 2008, and have no regrets. I mostly like REITs, but stocks like MO and F, plus a few mutual funds have also been good dividend payers.

Yes, these big market dips are the time to go bargain hunting. I haven't bought many during dips, but I do remember my best stock bargain was the 60 shares of AAPL I gambled on around 2000 at $25-28 a share. I spent about $1600 in three buys, and AAPL has now split a few times to turn 60 into 1600 today, so over 20 years later I'd say it pays to buy and hold! Another long term holding is F. It dipped all the way down to about $1 back during the 2008 market crash while GM and Mopar were looking for the guv to save them. I backed up the truck at $1.25 a share, but in looking back, should have used a bigger truck! It took F a couple of years to start paying a dividend again, but when they did they paid me back the cost of the stock every two years a few times over.

During the 2020 crash I mostly just added to REITs, and at present I'm looking to pick up some more GGT, which is paying around a 12% dividend now.

Just don't go crazy with any one stock, but diversify, diversify, diversify!

I've used high dividend paying stocks to add to my retirement income since retiring a few years early in 2008, and have no regrets. I mostly like REITs, but stocks like MO and F, plus a few mutual funds have also been good dividend payers.

Yes, these big market dips are the time to go bargain hunting. I haven't bought many during dips, but I do remember my best stock bargain was the 60 shares of AAPL I gambled on around 2000 at $25-28 a share. I spent about $1600 in three buys, and AAPL has now split a few times to turn 60 into 1600 today, so over 20 years later I'd say it pays to buy and hold! Another long term holding is F. It dipped all the way down to about $1 back during the 2008 market crash while GM and Mopar were looking for the guv to save them. I backed up the truck at $1.25 a share, but in looking back, should have used a bigger truck! It took F a couple of years to start paying a dividend again, but when they did they paid me back the cost of the stock every two years a few times over.

During the 2020 crash I mostly just added to REITs, and at present I'm looking to pick up some more GGT, which is paying around a 12% dividend now.

Just don't go crazy with any one stock, but diversify, diversify, diversify!

USNvet

FNG

- Joined

- Jul 12, 2022

- Messages

- 5

And here are some thoughts on a few other subjects I've seen mentioned in this thread...gold, silver, oil, and market direction from here.

With these super high inflation numbers the guv has released recently, shouldn't gold and silver be rising to maintain steady buying power? Everything else in the stores is going up and so should the precious metals! That is how it worked up until now, but why are they both now declining?

I think I found the answer in a Youtube channel I've been following for a few months now. Just search YT for Jake Broe and view a few of his videos. He has a very sharp mind when it comes to piecing the big picture together, not just regarding the stock market's direction, but also a lot about the economy, coming recession, and he does a great job in deciphering Russia's "Incursion" into Ukraine.

(Russia has no chance of winning unless NATO and the West stop sending guns and ammo to Ukraine)

Since much of the world is now boycotting Russia, they are desperate to raise money to throw at the war, and as the number one miner/seller of gold in the world, they still have two customers who are buying gold, India and China. Since these two countries know they have Russia by the balls, they are demanding a discount, therefore the price has been inching down in the legitimate world market, too. Russia also sells India and China discounted oil, causing it to also drop.

On top of the Russia/India/China monkey wrench in the economic works, Jake believes a recession is coming which will mean a slowing economy and more pressure on the price of oil, all meant to slow inflation with higher interest rates.

This is just a quick summation of what Jake Broe has talked about, and there is so much more to be learned from his channel. He is a former Air Force Captain who was in charge of ICBM nukes while on active duty, so really nothing to do with analyzing war strategies, or the markets, so he must have had a lot of free time to come up with his well reasoned thoughts!

With these super high inflation numbers the guv has released recently, shouldn't gold and silver be rising to maintain steady buying power? Everything else in the stores is going up and so should the precious metals! That is how it worked up until now, but why are they both now declining?

I think I found the answer in a Youtube channel I've been following for a few months now. Just search YT for Jake Broe and view a few of his videos. He has a very sharp mind when it comes to piecing the big picture together, not just regarding the stock market's direction, but also a lot about the economy, coming recession, and he does a great job in deciphering Russia's "Incursion" into Ukraine.

(Russia has no chance of winning unless NATO and the West stop sending guns and ammo to Ukraine)

Since much of the world is now boycotting Russia, they are desperate to raise money to throw at the war, and as the number one miner/seller of gold in the world, they still have two customers who are buying gold, India and China. Since these two countries know they have Russia by the balls, they are demanding a discount, therefore the price has been inching down in the legitimate world market, too. Russia also sells India and China discounted oil, causing it to also drop.

On top of the Russia/India/China monkey wrench in the economic works, Jake believes a recession is coming which will mean a slowing economy and more pressure on the price of oil, all meant to slow inflation with higher interest rates.

This is just a quick summation of what Jake Broe has talked about, and there is so much more to be learned from his channel. He is a former Air Force Captain who was in charge of ICBM nukes while on active duty, so really nothing to do with analyzing war strategies, or the markets, so he must have had a lot of free time to come up with his well reasoned thoughts!

DenverCountryBoy

WKR

- Joined

- Jun 17, 2017

- Messages

- 1,272

Gazprom declared force majeure and has suspended natural gas deliveries to Germany indefinitely.

Crude is up on the news.

www.zerohedge.com

www.zerohedge.com

Crude is up on the news.

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Similar threads

- Replies

- 91

- Views

- 5K

- Replies

- 2

- Views

- 418

- Replies

- 38

- Views

- 2K

Featured Video

Latest Articles

- Best Gear of 2025

- Swarovski AT Balance Review

- YETI Outdoor Kitchen Expansion

- The Art of Shed Hunting

- TT#72 Conquering the Super 10: Mike Kentner’s Hunting Journey

- Spring Black Bears with Joe Kondelis

- TT#71 Trail Goods Company – Partnering with Hunters for Epic Adventures

- Wyoming Elk with Biologist Lee Knox

- First Lite North Range Puffy Coat Review

- FORLOH BTM Jacket Review