Honest question, but how did you go about learning this? Talking tax codes, strategies, etc. any good ways to self teach this stuff? This has always intrigued me, but have not dedicated allot of effort to it yet.

I have a decent amount in the market. But have just gone the buy quality and hold forever route. Wouldn’t even consider doing what you guys do until I had a solid understanding of it.

"have not dedicated a lot of effort into it yet."

That's the kicker. A physician goes to school for more than half a decade to learn how to make a few hundred thousand dollars a year. People expect to make money trading in the market in their spare time. That's just not the case. It takes hundreds and thousands of hours to be consistently profitable.

First. Start small. A few k and expect to lose it. Just like the casino. Your first goal is to be consistently profitable. A few bucks at a time. Like 10 or 20.

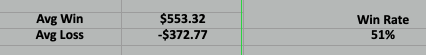

Second.Learn to lose. Seriously learn to lose well. The most profitable traders lose often but lose small. School and life has taught you that losing or averaging 60% is failure. That's absolute trash. Most of my strategies have a 50% win rate but they win more than they lose so over time I make money. 50% is failing in school. That mentality is crippling in trading.

Third. Spend time learning how your mind works and how to deal with your monkey brain emotions. I will say this again. Learning to trade is easy. Finding profitable trades is easy. Learning to manage your emotional monkey caveman brain is the hardest thing you will ever do in your entire life. It does not matter what trading style someone else has that they are successful at. Your brain and emotions are different. You have to find trades that fit YOU.

Fourth. Grow slowly. Your goal is consistent profitability over time. Not making a living RIGHT NOW! Grow size slowly. Your emotions can't handle big jumps in losses and wins no matter how much you make at your job or business. NOBODY is immune to this. NOBODY. Let that account compound. Once the annual profits from trading beat your regular income then you have some decisions to make.

Lastly, once you are profitable have real trading expectations out of yourself. This is not investing. 1% a month is terrible frankly. You need to be shooting for 5-10% in monthly average growth in your trading account. That's doable and achievable. This is a business. No one bats an eye at 5% return on capital a month for a new, small business. Same thing.

Great Youtube accounts for the mental game are Micheal Martin and Rande Howell. Everyone wants to find good trades and then wonders why they can't make money long term. The people that win figure out their trading emotions and conquer that. You can not win without figuring that out so start at the beginning.

Great books are the Market Wizards series and Best Loser Wins. Don't buy books on tactics and strategies. That stuff is free online. Backtesting software is well, well worth the price. Find some and use the crap out of it.