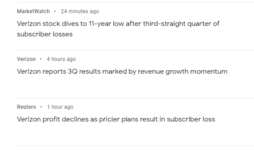

I need to look into these stories but here's a couple of my comments with a quick look see on VZ (nice rhyme, huh?). Also, the image is from today's news on VZ.Been buying into Verizon(VZ) in the last few days. At their 52 week low, solid company, makes tons of money, pays their dividend religiously, isn’t overloaded with debt. At today price it’s over a 7% dividend! It’s a long term hold for me.

7.5% is terrific but a DIV that large almost certainly has some above average risk. DIV payout ratio is a little high at 52%. It also has ~$300B in debt, which is somewhat worrisome if things go sideways.

Good luck to all reading this thread.

Eddie

P.S. Also, BH not trying to be argumentative (your money, your choice) but simply mentioning things that catch my eye and would need further research before I put my money in.