TaperPin

WKR

- Joined

- Jul 12, 2023

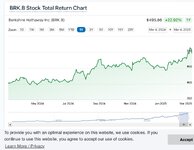

An acquaintance retired at 40 after making a killing day trading and he’s seeing the volatility in the market as a huge opportunity. Computer models have taken much of the profit potential away from day traders, but the rash of daily announcements seems to be providing all sorts of semi predictable movements in the market. Which funds are the quickest to take advantage of volatility like this?

I’m rather dumb and invest at recession bottoms like Warren Buffet - he’s cash rich right now, so I’m saving as much as possible to get cash levels up until he goes all in again. Lol

I’m rather dumb and invest at recession bottoms like Warren Buffet - he’s cash rich right now, so I’m saving as much as possible to get cash levels up until he goes all in again. Lol