Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bitcoin

- Thread starter Split toe

- Start date

And despite that investors who purchased 2 years ago are still up 56%. Time in market is always leads to greater gains than timing the market for the average investor.Msty just went through a reverse stock split, 5:1. And it has tanked even more since then.

I would wager you'll never see $50,000. againGuess I’ll buy at 50,000.

KsRancher

WKR

- Joined

- Jun 6, 2018

- Messages

- 911

I am hoping to see $134,000 by June 2027 and I will make my exit. I bought in June 2025 and that would give me a 12% annual return for 2yrs

Ah my mistake. For some reason I thought it started beginning of 2025.And despite that investors who purchased 2 years ago are still up 56%. Time in market is always leads to greater gains than timing the market for the average investor.

Beendare

"DADDY"

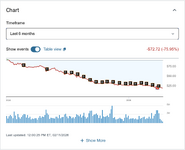

I'n not a strictly Technical Trader but I have found that looking that the charts gives me an idea of the general direction of the asset/Stock/whatever. This MSTY 6 mo chart is telling.Msty just went through a reverse stock split, 5:1. And it has tanked even more since then.

Do you guys even know what MSTY is comprised of?

Nope, It's not Bitcoin, its mostly leveraged Treasuries...derivatives that are leveraged 100%.

MSTY doesn't directly own MSTR shares; it creates exposure using options (short puts, long calls) to mimic owning them, allowing it to earn income without buying the stock. The fund sells call options on MSTR, collecting premiums for this income. A significant portion of its assets is held in cash and U.S. Treasury securities to back these positions. When MSTR's price falls, these premiums become a large portion of the payout, leading to a "Return of Capital" (ROC) distribution rather than income from profits. Because it's giving back principal (capital) as distributions, the fund's NAV drops, meaning the ETF's share price falls, offsetting the high payouts. The high yields rely heavily on MSTR's volatility. When MSTR's price drops, or volatility decreases, MSTY's ability to generate income from options weakens, forcing more ROC to maintain payout causing the share price to further decline.I'n not a strictly Technical Trader but I have found that looking that the charts gives me an idea of the general direction of the asset/Stock/whatever. This MSTY 6 mo chart is telling.

View attachment 1019925

Do you guys even know what MSTY is comprised of?

Nope, It's not Bitcoin, its mostly leveraged Treasuries...derivatives that are leveraged 100%.

2531usmc

WKR

- Joined

- Apr 5, 2021

- Messages

- 739

In plain English, what does this mean?MSTY doesn't directly own MSTR shares; it creates exposure using options (short puts, long calls) to mimic owning them, allowing it to earn income without buying the stock. The fund sells call options on MSTR, collecting premiums for this income. A significant portion of its assets is held in cash and U.S. Treasury securities to back these positions. When MSTR's price falls, these premiums become a large portion of the payout, leading to a "Return of Capital" (ROC) distribution rather than income from profits. Because it's giving back principal (capital) as distributions, the fund's NAV drops, meaning the ETF's share price falls, offsetting the high payouts. The high yields rely heavily on MSTR's volatility. When MSTR's price drops, or volatility decreases, MSTY's ability to generate income from options weakens, forcing more ROC to maintain payout causing the share price to further decline.

Beendare

"DADDY"

The Financial times came out with a piece [behind a paid subscription] but it can be seen on CNBC

CNBC interview Jemima Kelley on CNBC about the logic behind the article HERE...and it's right on the money IMO.

Even the Bitcoin trading desk folks are saying Bitcoin is weak and looking like it has another leg to drop. It would be worth watching ETF inflow/outflows as those are probably the key to direction. Mostly outflows in the last few months...but I saw one where they said it blipped up just a tad in the last week.

Now the Michael Saylor's of the world that own MSTR and a pile of Bitcoins are always going to be talking it up....which is exactly what the Financial Times is saying with their Headless Ponzi scheme comment.

Look, don't shoot the messenger here.......Lots of good recent analysis from trading desks and such if you search CNBC and Google..

If you do that search you find two distinct groups; Those that own Crypto and are talking it up pushing the lesser fool theory...and those that don't own Crypto for the reasons in that video.

Bitcoin’s value is zero and the scarcity argument is pretend

CNBC interview Jemima Kelley on CNBC about the logic behind the article HERE...and it's right on the money IMO.

Even the Bitcoin trading desk folks are saying Bitcoin is weak and looking like it has another leg to drop. It would be worth watching ETF inflow/outflows as those are probably the key to direction. Mostly outflows in the last few months...but I saw one where they said it blipped up just a tad in the last week.

Now the Michael Saylor's of the world that own MSTR and a pile of Bitcoins are always going to be talking it up....which is exactly what the Financial Times is saying with their Headless Ponzi scheme comment.

Look, don't shoot the messenger here.......Lots of good recent analysis from trading desks and such if you search CNBC and Google..

If you do that search you find two distinct groups; Those that own Crypto and are talking it up pushing the lesser fool theory...and those that don't own Crypto for the reasons in that video.

Johnny Tyndall

Lil-Rokslider

MSTY makes money by placing bets on the price of MSTR. In order to place the bets they need some collateral. For collateral they own a lot of treasuries. If they aren't making enough on the bets they have to use some of their collateral for payouts to their shareholders. If they're paying out their collateral, their share price goes down. That's how I read it at least.In plain English, what does this mean?

Know! I own zero cryptoI would wager you'll never see $50,000. again

2531usmc

WKR

- Joined

- Apr 5, 2021

- Messages

- 739

George Noble was Peter Lynch’s assistant at Fidelity Investments. After Lynch retired, he started to manage Fidelity’s Overseas Investment Fund and ended up being the top performing Fidelity fund manager. You can follow him on X.

He is very anti BTC. He said purchasing BTC is like buying air. He thinks it’s complete nonsense

He also has some interesting thoughts about AI. He thinks it will never come even close to the promises being made and the malinvestment is enormous.

He is very anti BTC. He said purchasing BTC is like buying air. He thinks it’s complete nonsense

He also has some interesting thoughts about AI. He thinks it will never come even close to the promises being made and the malinvestment is enormous.

MSTY exists to buy/sell options on MSTR (betting on the price going up or down). MSTY borrows the money to purchase the options (leverage) and use their capital (the money you invested in MSTY) to buy treasury bonds to put up as collateral. The money they make from buying/selling the options on MSTR is paid out weekly to the shareholders. If the fund managers fail to reach their target profit for the week they supplement the shortfall by returning some of the funds capital thus causing the value of the fund (share price) to decline. The fund performs great when MSTR is trending up (paid out 200% dividends in 2024). When MSTR is going down the majority of the weekly dividend is a return of capital which causes the share price to decline. Bitcoin has been trending down so MSTR (BTC treasury company) is trending down.In plain English, what does this mean?

If BTC goes down, MSTR shares go down causing MSTY shares to go down. Owning MSTY is great when BTC is going up. OK when BTC is trading sideways. Bad when BTC is trending down. Still pays a high dividend (65% dist rate ytd) regardless of BTC's price action but when BTC trends down your MSTY share price goes down.

PNW bow hunter

WKR

- Joined

- Jan 10, 2016

- Messages

- 626

That was a very clear, and easy to understand explanation.MSTY exists to buy/sell options on MSTR (betting on the price going up or down). MSTY borrows the money to purchase the options (leverage) and use their capital (the money you invested in MSTY) to buy treasury bonds to put up as collateral. The money they make from buying/selling the options on MSTR is paid out weekly to the shareholders. If the fund managers fail to reach their target profit for the week they supplement the shortfall by returning some of the funds capital thus causing the value of the fund (share price) to decline. The fund performs great when MSTR is trending up (paid out 200% dividends in 2024). When MSTR is going down the majority of the weekly dividend is a return of capital which causes the share price to decline. Bitcoin has been trending down so MSTR (BTC treasury company) is trending down.

If BTC goes down, MSTR shares go down causing MSTY shares to go down. Owning MSTY is great when BTC is going up. OK when BTC is trading sideways. Bad when BTC is trending down. Still pays a high dividend (65% dist rate ytd) regardless of BTC's price action but when BTC trends down your MSTY share price goes down.

Great job

The few sources I have read about this stock didn’t even come close to doing that good of a description!

Brazil Eyes 1 Million Bitcoin For National BTC Reserve

Brazilian lawmakers have reintroduced a bill proposing the creation of a Strategic Sovereign Bitcoin Reserve (RESBit) to acquire one million Bitcoin over five years.

bitcoinmagazine.com

bitcoinmagazine.com

Ric Edelman is a renowned American financial advisor, educator, and #1 New York Times bestselling author of 14 books and is recognized for founding Edelman Financial Services in 1986, which grew into one of the nation's largest independent financial planning firms, managing roughly $330 billion in assets for 1.4 million households. Edelman has been ranked the #1 Independent Financial Advisor three times by Barron's and recognized as one of the most influential people in the financial services industry.

In this interview Ric predicts that Bitcoin will reach $500,000 by 2030.

In this interview Ric predicts that Bitcoin will reach $500,000 by 2030.

MuleyFever

WKR

BTC predictions are like a-holes.

Do you agree with Ric Edelman that BTC will reach 500k by 2030?BTC predictions are like a-holes.

Beendare

"DADDY"

We get it...you guys heavy into Bitcoin need to keep pumping it.Do you agree with Ric Edelman that BTC will reach 500k by 2030?

Then there are the independents, like this Article from Bloomberg;

- Bloomberg strategist Mike McGlone warned Bitcoin could fall to $10,000.

- Critics continue to question Bitcoin’s investment case.

- Institutional adoption remains active despite volatility.

Like I said, I have no dog in this fight, I don't care whether it goes to $500k or $10k....but its obvious a guy needs to trade this technically since it has no fundamental value....and the chart looks weak.

Last week had the Bitcoin conference to pump it up....moving forward technicals and hype will rule.

BuckSmasher

Lil-Rokslider

Can you explain what this means in plain english?....but its obvious a guy needs to trade this technically since it has no fundamental value....and the chart looks weak.

Similar threads

- Replies

- 7

- Views

- 670

- Replies

- 51

- Views

- 2K

Featured Video

Latest Articles

- How Old Was He Really? Big Buck Hunters Talk Age vs. Score

- Banning Hunting Technology in Idaho?

- Best Gear of the year Rokslide staff edition 2025 Article

- Hunting Gear: Insights from Western Hunting Expo

- Black Diamond Alpine Start Insulated Hoody Review

- Tenacity Firearms with Andrew Whitney

- The Thrill of Moose Hunting with Henry Ferguson

- Final Rise Upland Hand Muff Review

- Kodiak Deer Hunt Round II

- Killing a Timber Giant