With the SP500 you are spreading your risk across the 500 largest publicly traded companies in the US.I know I keep being thw Debbie downer here. But if its one of the least risky bets out there. Why "only put in what your willing to lose". I am asking sincerely. I have never heard that about something like the S and P 500

Since its expansion to 500 stocks in 1957, the average annual return has been around 10–12%.

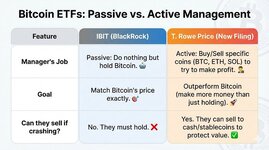

Bitcoin's average annual return is 230%. Volatility is the price you pay for the 20X returns. Not many people can watch their entire portfolio tank 80% without selling and locking in their losses. It takes a strong will to hold during these huge downturns like we are in now. I have 50% of my portfolio in BTC/BTC ETF's and BTC proxies like MSTR. I've been through several big downturns in the past and I continue to HOLD and add to my positions during these times. Why? Because I have conviction that BTC will continue to outperform every other possible investment over my time horizon.