Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bitcoin

- Thread starter Split toe

- Start date

Poser

WKR

I have a self managed IRA that is loaded up with BTC etfs and ETHE (ethereum trust that will convert to the ETF once available). This is seperate from my 401k which is a conservative play. In terms of buying actual BTC directly, I don't. have much but I do hold and regularly put more money into ETH.

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 1,526

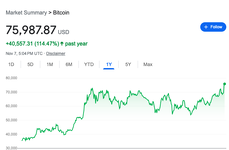

We have Larry Fink giving Bitcoin a ringing endorsement, and now Trump says Jamie Dimon has “changed his tune” on Bitcoin. What are your thoughts? I certainly won’t be betting against Blackrock.

All good things for the price of btc….even though I don’t trust them ha. ETFs , MSTR and btc having a good pump today.

Sent from my iPhone using Tapatalk

Poser

WKR

What are the ETH etfs? Is there something you can buy now that rolls over automatically?

ETHE is grayscale’s ethererum trust which will roll over into an etf

Sent from my iPhone using Tapatalk

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 1,526

ETHE is grayscale’s ethererum trust which will roll over into an etf

Sent from my iPhone using Tapatalk

If it’s anything like GBTC it will dump, but who knows with new management.

Sent from my iPhone using Tapatalk

It’s even worse with fees at 2.5%! I’m not sure what angle they are trying to play, but the offerings from VanEck, Bitwise, BlackRock, etc are 1/10 the fees. I would imagine some people will dump ETHE for cheaper options, but then again they may not want to realize the capital gains to do so.If it’s anything like GBTC it will dump, but who knows with new management.

Sent from my iPhone using Tapatalk

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 1,526

MSTR is planning on spending $10 billion next year on BTC, that’s more than they have spent in total since their first buy in 2020.

Trump stated he is going to buy 5% of btc total holdings, so just over 1 mil btc.

Lots of good things to come.

Sent from my iPhone using Tapatalk

Historybuff

Lil-Rokslider

- Joined

- Jan 28, 2017

- Messages

- 265

william schmaltz

WKR

I hope everyone listened. We are 29 weeks past halving. Ripping all time highs and retail hasn’t even started to buy yet. Coinbase isn’t even top 200 in App Store yet.Mini crashes and the bear cycle are baked into the cake at this point. The average time from the halving to the cycle’s ATH is about 70 weeks. For the first 20-30 weeks we will have big money rolling in. This will be the time when all the news people and politicians will be screaming about the warnings and asking for regulation while they’re buying it in the evenings. Then they will change their tone and honey d!ck the average retail investor and drive up price. For 20-30 weeks we will see average Joe who already missed out on 10x gains FOMO in to not miss the next 10x. I’ve said rather tongue-in-cheek sell when Coinbase hits #1 in App Store, well that’s when that part happens. We call those guys exit liquidity. That’s when we see the big institutional sell offs. The headlines about scams and probably something about how China outlawed something will be back. Retail guys that didn’t practice risk management and did zero research who lost their ass go back to the office warning their coworkers. Finally they all give up and get out. That gives us the final push down. If we’re lucky, everything has pulled back 60-80% at this point. This thread gets resurrected with the “I told you so” crowd. Those of us that have already took the ride for 2-3 cycles buy. And this thread gets resurrected in 2028 by someone asking if they should buy.

Four year cycle.

Poser

WKR

I hope everyone listened. We are 29 weeks past halving. Ripping all time highs and retail hasn’t even started to buy yet. Coinbase isn’t even top 200 in App Store yet.

Four year cycle.

I've been buying BTC (Grayscale Bitcoin Mini Trust ETF) and ETH (GRAYSCALE ETHEREUM MINI TR ETH COM UNIT ETH) steadily during this timeframe. I'm particularly stacked on ETH.

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 1,526

I hope everyone listened. We are 29 weeks past halving. Ripping all time highs and retail hasn’t even started to buy yet. Coinbase isn’t even top 200 in App Store yet.

Four year cycle.

73 days until strategic reserves…

MOASS

MOASSSent from my iPhone using Tapatalk

Historybuff

Lil-Rokslider

- Joined

- Jan 28, 2017

- Messages

- 265

Might want to get some just in case it catches on

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 1,526

Historybuff

Lil-Rokslider

- Joined

- Jan 28, 2017

- Messages

- 265

Poser

WKR

The State of Michigan Retirement System announced that they will be maintaining bitcoin going forward and added Ethereum ETFs to the pension. I think you'll see a lot more pensions adding on Crypto assets going forward.

Next bit of info to watch for is Ethereum ETF staking. If staking gets approved for ETH ETFs, ETH is going to go nuts. Currently you can stake ETH in the actual crypto form at around 2% or so. If ETF staking is approved, you'll start earning dividends on ETH ETF holdings, in which case it will only make sense that retirement accounts go heavy on ETH.

Next bit of info to watch for is Ethereum ETF staking. If staking gets approved for ETH ETFs, ETH is going to go nuts. Currently you can stake ETH in the actual crypto form at around 2% or so. If ETF staking is approved, you'll start earning dividends on ETH ETF holdings, in which case it will only make sense that retirement accounts go heavy on ETH.

Similar threads

- Replies

- 5

- Views

- 990

- Replies

- 51

- Views

- 2K

Featured Video

Latest Articles

- The Art of Shed Hunting

- TT#72 Conquering the Super 10: Mike Kentner’s Hunting Journey

- Spring Black Bears with Joe Kondelis

- TT#71 Trail Goods Company – Partnering with Hunters for Epic Adventures

- Wyoming Elk with Biologist Lee Knox

- First Lite North Range Puffy Coat Review

- FORLOH BTM Jacket Review

- TT#70 Chasing the Grand Slam: A Sheep Hunter’s Journey

- Vortex Triumph HD 850 Rangefinder Review

- Utah Buck Data & New Co-Host Jaden Bales