Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Credit Card?

- Thread starter EATELK

- Start date

Agreed. I have literally never paid a penny of interest. But as stated above, you have to be disciplined about your spending.I just paid for all my Christmas purchases with my rewards points while never paying a cent to interest.

Seems like a no brainer to me….

iamthenick

Lil-Rokslider

- Joined

- Nov 28, 2023

- Messages

- 140

Amazon has a 5% back card that's 1 to 2% everywhere else too.

We wear that thing out.

We wear that thing out.

Charlie Brown

Lil-Rokslider

- Joined

- Jul 10, 2020

- Messages

- 144

Have 2 credit cards. Cabela's for the points and one through my bank for the Cashback option. Don't use either all that often but they are paid off each month when used. I never use to purchase if I don't have the money to pay them off.Man, I have to ask.

As someone that tries to never use credit cards. Why not pay yourself back?

I just feel like its a scam to use a CC for cash back or frequent miles whatever they are offering.

I will use the zero percent financing and pay it off in time.

Why not toss a hundred or two in some sort of high earning savings account?

Open an IRA?

Too many better options than making payments for "cashback".

Just my opinion here.

I do the same. The cash back invested with compound interest adds up over time!I have a Fidelity 2% cash back card and at the end of the month it can be deposited directly into an investment account. It’s great.

- Banned

- #26

Steve300xcw

WKR

- Joined

- Oct 19, 2017

- Messages

- 3,216

Man, I have to ask.

As someone that tries to never use credit cards. Why not pay yourself back?

I just feel like its a scam to use a CC for cash back or frequent miles whatever they are offering.

I will use the zero percent financing and pay it off in time.

Why not toss a hundred or two in some sort of high earning savings account?

Open an IRA?

Too many better options than making payments for "cashback".

Just my opinion here.

Used to have the same thoughts. But I was wrong, and dumb for not playing the game.

Use the thing just like your debit card. Pay your bills and buy what your are goona buy with the thing. Pay it off each month a few days before its due. Money leaves your checking account just the same. Except you get $100-$200+ back each month. What's not to like? I just roll that money back into next months payment.

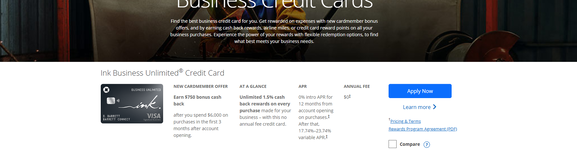

I signed up for a chase card for my business a few months back. 1.5% back on all purchases....And $750 if you use the card for $6k within the first 3 months..... I am not going to bitch about free money!

Chase pretty much gave me a tikka, just for paying my bills...............Think about it

Now keep much of a balance on those cards and your asshole will bleed.............

Last edited:

I am going to look into this. Its just hard to shake the evil CC mentality. And I watch my dipshit friends rack up insane debit while I am working on my 2nd government pension.

I work with a 30 year old girl that seems proud to only have $20.00 to here name a week after pay. A while I am moving various money into investments I have.

I defiantly need to look into this cash back more.

Anybody use sportsman warehouse? I have one close and buy from them.

I have an REI MasterCard, Apple card, and a best buy card all with zero balance.

HuntHarder

WKR

Rewards are able to be offered by Cc companies because of the people who do not pay their card off each month.

As others have said, I literally get over a thousand dollars free each year, just for using my cards. Pay them off each month and you will never pay a cent of interest. My travel card has a 95$ yearly fee, but offers 100$ in baggage fees reimbursement, as well as free TSA precheck.

A disciplined individual will come out far ahead with the rewards of CC's. Someone who lacks self control or is terrible with money, will lose even more money with CC's.

BofA signature is the one I use the most

As others have said, I literally get over a thousand dollars free each year, just for using my cards. Pay them off each month and you will never pay a cent of interest. My travel card has a 95$ yearly fee, but offers 100$ in baggage fees reimbursement, as well as free TSA precheck.

A disciplined individual will come out far ahead with the rewards of CC's. Someone who lacks self control or is terrible with money, will lose even more money with CC's.

BofA signature is the one I use the most

Steve300xcw

WKR

- Joined

- Oct 19, 2017

- Messages

- 3,216

I have to admit, I've followed my late fathers advise of paying in cash and dont spend more than you make. Which the later makes since to anyone.

I am going to look into this. Its just hard to shake the evil CC mentality. And I watch my dipshit friends rack up insane debit while I am working on my 2nd government pension.

I work with a 30 year old girl that seems proud to only have $20.00 to here name a week after pay. A while I am moving various money into investments I have.

I defiantly need to look into this cash back more.

Anybody use sportsman warehouse? I have one close and buy from them.

I have an REI MasterCard, Apple card, and a best buy card all with zero balance.

Like I said, I had the same thoughts for a long time. Let a lot of free money get away from me because of it.... You are spending that money regardless.. Might as well get a lil of it back

If you are like me, and it sounds like you might be

No balance means you dont pay interest....

Rewards are able to be offered by Cc companies because of the people who do not pay their card off each month.

That and the CC fees to every business that runs that card........

CorbLand

WKR

- Joined

- Mar 16, 2016

- Messages

- 9,557

It’s not that the advice was bad, it’s just the world has changed and it’s best if you find a way to change with it.I have to admit, I've followed my late fathers advise of paying in cash and dont spend more than you make. Which the later makes since to anyone.

I am going to look into this. Its just hard to shake the evil CC mentality. And I watch my dipshit friends rack up insane debit while I am working on my 2nd government pension.

I work with a 30 year old girl that seems proud to only have $20.00 to here name a week after pay. A while I am moving various money into investments I have.

I defiantly need to look into this cash back more.

Anybody use sportsman warehouse? I have one close and buy from them.

I have an REI MasterCard, Apple card, and a best buy card all with zero balance.

Duh

WKR

- Joined

- Apr 5, 2023

- Messages

- 962

I have a Scheels card. I spend most of my slush fund money there anyways. Basically get store credit back.

I hear ya. Learn something daily at this placeIt’s not that the advice was bad, it’s just the world has changed and it’s best if you find a way to change with it.

woods89

WKR

First off, never, ever, ever pay interest in a credit card. They must be paid off every month!

That said, I play the game fairly hard. I currently have 5 Chase cards.

Personal

-Chase Sapphire Preferred

-Chase Freedom Flex

-Chase United Explorer

Business

-Chase Ink Unlimited

-Chase Amazon

I transfer earned points from the Freedom Flex and Ink Unlimited to my Sapphire Preferred, as then I can transfer them to various airline or hotel loyalty programs, and get better than 1-1 redemption value. The United Explorer card gets me some flying perks, and the Amazon card gets 5% back on all Amazon purchases.

That said, I play the game fairly hard. I currently have 5 Chase cards.

Personal

-Chase Sapphire Preferred

-Chase Freedom Flex

-Chase United Explorer

Business

-Chase Ink Unlimited

-Chase Amazon

I transfer earned points from the Freedom Flex and Ink Unlimited to my Sapphire Preferred, as then I can transfer them to various airline or hotel loyalty programs, and get better than 1-1 redemption value. The United Explorer card gets me some flying perks, and the Amazon card gets 5% back on all Amazon purchases.

Thanks all for the replies. I should've added, I'm not looking at APR rates at all since I religiously pay it off each month. Agreed with some of the posts that you can get into trouble if you don't stay on top of payments. I've been leery of opening and closing credits cards (had the same ones for 10yrs) due to concerns of it hurting credit scores, but should probably be more open to playing the game and collecting the sign up bonuses.

Still leaning towards a 2% cash back card for all purchases like the Wells Fargo Active Cash, but should probably scrutinize my spending more to see if a card that offers additional rewards for restaurants, etc would be beneficial.

Still leaning towards a 2% cash back card for all purchases like the Wells Fargo Active Cash, but should probably scrutinize my spending more to see if a card that offers additional rewards for restaurants, etc would be beneficial.

Would you mind sharing which card that is?For the doubters, you are leaving hundreds if not thousands of free money on the table every year. The wife and I just churned a couple cards and got $1500 back in signup bonuses. Just to buy normal stuff we buy anyway.

Today I was told about a cash back card that does 3% on every day purchases and up to 5% at restaurants etc. I was told there is a $60 yearly fee. I’ll probably get one since there isn’t much out there that can beat that.

Arkangel86

Lil-Rokslider

- Joined

- Jan 4, 2021

- Messages

- 110

I have been playing this game for over a decade, I have over 25 personal and 3 business cards, just gotta be disciplined.

Free vacations, flights, kuiu, waders, guns, cash back, you name it.

Another benefit I didnt see mentioned is most cards double your warranty on products you buy, used that a couple times already and got full price reimbursement.

Free vacations, flights, kuiu, waders, guns, cash back, you name it.

Another benefit I didnt see mentioned is most cards double your warranty on products you buy, used that a couple times already and got full price reimbursement.

Tjdeerslayer37

Lil-Rokslider

the score hit is so minor when getting a new card it really doesnt matter. and the benefit of having a higher available credit to credit used ratio is unmatched. this is also why you should request a credit limit increase every 6 months or whenever you are allowed on every card you have, so your credit usage ratio is lower and lower. really pumps your credit score!Thanks all for the replies. I should've added, I'm not looking at APR rates at all since I religiously pay it off each month. Agreed with some of the posts that you can get into trouble if you don't stay on top of payments. I've been leery of opening and closing credits cards (had the same ones for 10yrs) due to concerns of it hurting credit scores, but should probably be more open to playing the game and collecting the sign up bonuses.

Still leaning towards a 2% cash back card for all purchases like the Wells Fargo Active Cash, but should probably scrutinize my spending more to see if a card that offers additional rewards for restaurants, etc would be beneficial.

Similar threads

- Replies

- 57

- Views

- 3K

- Replies

- 53

- Views

- 3K

- Replies

- 71

- Views

- 9K

Featured Video

Latest Articles

- How Old Was He Really? Big Buck Hunters Talk Age vs. Score

- Banning Hunting Technology in Idaho?

- Best Gear of the year Rokslide staff edition 2025 Article

- Hunting Gear: Insights from Western Hunting Expo

- Black Diamond Alpine Start Insulated Hoody Review

- Tenacity Firearms with Andrew Whitney

- The Thrill of Moose Hunting with Henry Ferguson

- Final Rise Upland Hand Muff Review

- Kodiak Deer Hunt Round II

- Killing a Timber Giant