Customweld

WKR

Keep this thread on point.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

It really is your call but you would pay far less in interest financing the portion of funds you need and paying it off in a couple months than you will either selling for a loss or the taxes you will pay on the gains.Thanks guys. To be clear I'm not selling a ton. I need to sell like 5 shares to be able buy this truck in cash (I already have some liquid funds / emergency money). I'm not into financing anything at this time.

The timing just sucks. Just bought a horse and a horse trailer and then my truck shit the bed this weekend.

Sent from my SM-G990U using Tapatalk

Absolutely...what's on your buy list? I usually have few for resets like this, but too many unknowns/uncharted waters. I bought a few at the close Friday (brk.b, WM, uber) to round out some gaps flushed out by Mag7...i'm sure theres some opportunities in Mag7, but man they've been routed this yr...MSFT and META seems to have the best long term case currentlyKeep this thread on point.

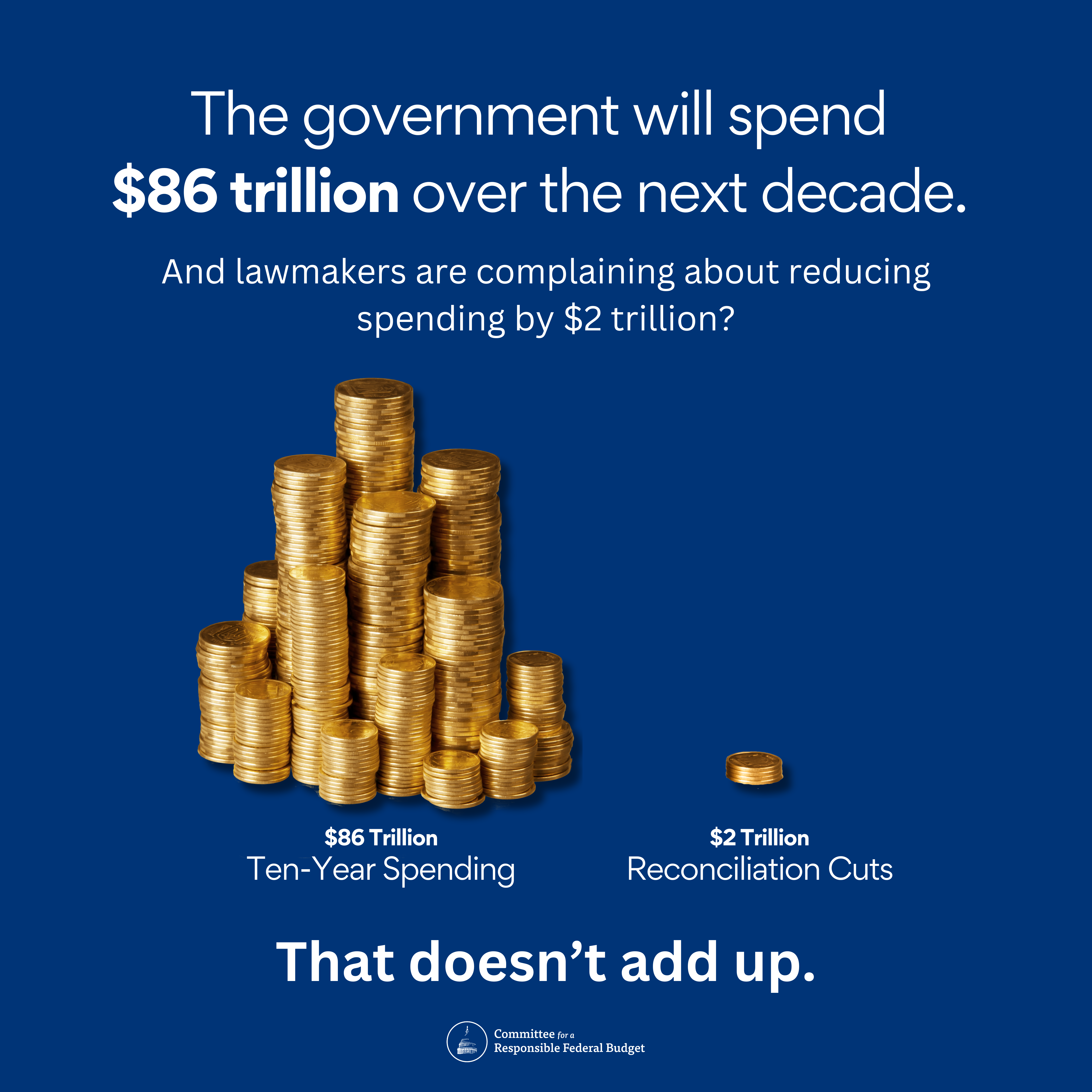

by cutting costsI mean, what? You borrow when your spending exceeds your income.

How do you suppose these unfunded tax cuts get paid for? We issue bonds. That's borrowing.

Side note. The entire point of the establishment of 401Ks was to add volume and liquidity to the market to the big guys could make more money. Same thing for making retail trading easier. More daily volume equals more money being transferred equals more money to be made.My thoughts are not technical but a general market observation.

Decades ago, investors were a relatively small group with "a guy/broker" doing the buy and sell often in 100 share lots. A niche of money geeks and what not.

Now, everyone is bought into the market, whether on an app, online account or most importantly their work 401k. Common as common can be.

That plays out by holding up the market. 401k admins are buying because they have to. Are they Berkshire big purchase, no. Not in a huge single entity but total dollars yes. Overall money now HAS TO GO IN. Vs the past where market geeks caused more extreme swings as they held or sold.

How much of the overall market is institutions at this point? Did it rewrite how this all plays out?

Agree to disagree, huge cult following and you pay for the ecosystem. Cash machineDon't like apple it is really a subscription service play nothing innovative

But year after year the ceiling gets raised, including last month's spending billYou reduce spending. It's not rocket science.

It is a long term cash machine, but seems like hearing next earnings and guidance will be illustrative, as they may really be eating it with the China trade warAgree to disagree, huge cult following and you pay for the ecosystem. Cash machine

So, is this the dead cat bounce?

MSFT is VERY well positioned. Yes, some hardware exposure given the Surface PCs, but remember, they have a massive forced upgrade cycle coming this Dec with end of support for Windows 10.Been following this thread for years and to keep it on track (the 4-5 rascals the trash every thread really hurt the site)

Tech I held my nose and bought last Friday

NVDA -> almost caught the bottom

MSFT -> powers everything and I am huge Azure user

TSLA -> innovation, model Y change over

DDOG great software, I prefer it to Splunk

2022 crash I went heavy and bought

Google and Amazon doing very well on them still even after the latest "crash"

Wild card is FUBO, bought a bunch at 1.70 a few months back since I saw it as a top app on the amazon firestick, it bumped to $6 with Disney news still holding but I'm still up 80%

Don't like apple it is really a subscription service play nothing innovative

Granted I work in tech but buy stuff you know and use at good discounts when possible

I thought it was October not December?MSFT is VERY well positioned. Yes, some hardware exposure given the Surface PCs, but remember, they have a massive forced upgrade cycle coming this Dec with end of support for Windows 10.

Since PC prices will jump due to tariffs, those who can upgrade the OS on existing hardware will pay the vig to upgrade the OS.

A lot of enterprises that might have been tempted to buy new hardware will shift the purchases to software upgrades and keep the hardware they have. MSFT makes money either way, but the direct OS purchases have higher margins.

**I'm Long MSFT and currently hold a position**

Thats what I'm thinking....but who knows.So, is this the dead cat bounce?