Danny Hoey

WKR

monthly buy time for my Roth. Went with APLD. Lowered my average a bit. Seems beat up a bit, maybe will drop a little more but I’ll DCA for a bit on it.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Do you think it's shenanigans...or some truth to the comment that this AI thing is getting ahead of itself? I would agree, it feels like we will see another leg down.NVDA getting slammed over China shenanigans. I guess holding 120 wasn't to be. TSM same deal.

I thinks it’s both. The recent price action (drop) was due mostly to China reiterating their stance to their companies urging them to not buy the special for China H20 chips due to not meeting their energy standards. They did this last year too. China energy standards? Shenanigans? NVDA says they can make that chip meet the standards. We will see. Another factor is Huawei is catching up with it’s AI. I’d agree AI has been a bit overblown but that’s the market capitalizing on and taking advantage of “the news”. Throw in the tariff dance too.Do you think it's shenanigans...or some truth to the comment that this AI thing is getting ahead of itself? I would agree, it feels like we will see another leg down.

I didn’t look at it today until now. Holy cow, that sucker got stomped. 22% crushMight want to keep an eye on GameStop tomorrow

I didn’t look at it today until now. Holy cow, that sucker got stomped. 22% crush

Got nothing positive to say. Oil is in limbo right now. So may things going on no way to know where it's going.PR gang where we at

Watching the CRWV IPO initial pricing and action today mby confirms AI has been a little overblown and mby headed to more realistic pricing. Let's see where it settles out. AAPL, TSM, NVDA all slipping further today. AAPL entered death cross territory yesterday as well.or some truth to the comment that this AI thing is getting ahead of itself?

Yes to a falling wedge (bullish) from which it did breakout, but it is currently retesting the resistance trendline. It'll be interesting to see if it maintains.Apparently GME broke out of its downward wedge, and is expected to rebound up. I don’t chart so I have no idea on that.

You beat me to it @MountainTracker.

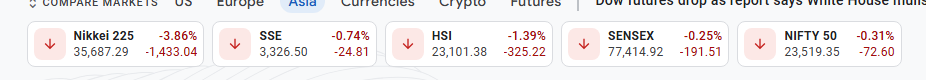

Looks rather ugly for Monday morning IMHO.

Eddie

View attachment 860827

View attachment 860828

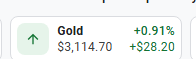

And on the bright side....

View attachment 860829

The non stop issuing of debt by the Fed has diluted the dollar to the point of being worthless, that's what gold is telling us, This system is Kaput.