- Banned

- #12,821

DapperDan

WKR

- Joined

- Oct 25, 2012

- Messages

- 1,655

Wish I had the time to invest by sitting and learning more bc these guys print money in this discord.

Sent from my iPhone using Tapatalk

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

PLTR

My ass hurts.

P

Anyone else buy the MSTR dip this morning? I picked up a few more shares, hoping for a quick 7-10% on these.

Well, this quick 7-10% is going the wrong way.Anyone else buy the MSTR dip this morning? I picked up a few more shares, hoping for a quick 7-10% on these.

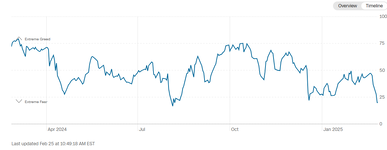

I’ve been expecting BTC to break down below 90k and eventually down to 74k ish…but not enough to take profits when it was 100-108kWell, this quick 7-10% is going the wrong way.

I set a buy order at $2.20 about 6 weeks ago... changed my mind at the last minute... thank goodness.Somebody say when on KULR

You and me both.I’ve been expecting BTC to break down below 90k and eventually down to 74k ish…but not enough to take profits when it was 100-108k

I’ve got to work on my profit taking skills.