Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Rokslide Stock Traders Thread

- Thread starter Kilboars

- Start date

Bullzeyez61

FNG

- Joined

- Mar 19, 2022

- Messages

- 38

I sold at .85 26,000 shares of Kulr…. I knew it was going to pop up and hold I didn’t think the time was now tho. My stomach sure hurts today.. With the valuation of some of these small companies running the last month I would not be surprised if it keeps running even up to 5$ before next earnings.

CaliWoodsman

WKR

KULR...to hodl or unloadl, that is the question. I'm not taking any profits yet.

Trybendr

FNG

- Joined

- Jan 10, 2020

- Messages

- 36

KULR

CorbLand

WKR

- Joined

- Mar 16, 2016

- Messages

- 9,456

stevewes2004

WKR

Doubled or tripled (cant remember which it was) my money with PR a couple years back and thought I was doing good there. I got in around 50 cents a share.

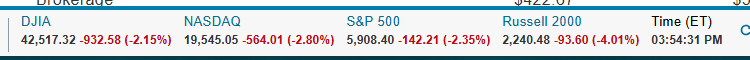

View attachment 808084

Ouch

Sent from my iPhone using Tapatalk

CorbLand

WKR

- Joined

- Mar 16, 2016

- Messages

- 9,456

Also played the game with HCMC a couple years ago. Sold when I was up 400%. Turned 200 bucks in to 800 in a couple days. If I would have waited about twice that long it would have been 200 into ~13000.Ouch

Sent from my iPhone using Tapatalk

Its hard to lose money when you take profits though.

aftriathlete

WKR

- Joined

- Jan 18, 2022

- Messages

- 478

I sold my KULR at $2.55, i was in at .22. Felt the strong urge to turn it into real money after watching some other stocks I had pump and dump in the last few months.

Last edited:

MountainTracker

WKR

- Joined

- Mar 8, 2014

- Messages

- 1,537

I sold my KULR at $2.55, i was in at .22. Felt the strong urge to turn it into real money after watching some other sticks I had pump and dump in the last few months.

Eh 11x is awesome man, can’t be upset by that. Congrats

Sent from my iPhone using Tapatalk

stevewes2004

WKR

I sold my KULR at $2.55, i was in at .22. Felt the strong urge to turn it into real money after watching some other sticks I had pump and dump in the last few months.

Good job for holding as long as you did!

Sent from my iPhone using Tapatalk

idahomuleys

Lil-Rokslider

- Joined

- Oct 26, 2015

- Messages

- 277

I usually don't like to sell on these big runs but what KULR is doing is crazy. Got it in March at .14. If it had been a full year I'd probably sell it off but going to HODL at least until then.

Sent from my SM-S928U using Tapatalk

Sent from my SM-S928U using Tapatalk

aftriathlete

WKR

- Joined

- Jan 18, 2022

- Messages

- 478

I might get to buy back in before long. I don't necessarily want to see it fall, but it's down 17% since I sold a couple hours ago. If I see it get back down towards $1.50 I'll be thinking about putting some back in the account.

A

Article 4

Guest

The IRS has announced adjustments to the amounts individuals can contribute to 401k and other retirement plans in 2025. See the table below as well as the notes regarding certain items.

| Plan Type | Amount | Notes |

| 401(k), 403(b), 457 Elective Deferral | $23,500 | refers to employee contribution only |

| Catch-Up Contribution | $7,500 | must be 50 or older in 2025 |

| Enhanced Catch-Up Contribution | $11,250 | must be at least 60 but not older than 63 in 2025 |

| SIMPLE Elective Deferral | $16,500 | refers to employee contribution only |

| SIMPLE Catch-Up Contribution | $3,500 | must be 50 or older during the year |

| SIMPLE Enhanced Catch-Up Contribution | $5,250 | must be at least 60 but not older than 63 in 2025 |

| SEP Deferral | $70,000 | or 25% of income whichever is less |

| Traditional & Roth IRA Limit | $7,000 | contributions may be limited by income |

| Traditional & Roth IRA Catch-Up Limit | $1,000 | must be 50 or older in 2025 |

| HSA Individual Contribution Limit | $4,300 | |

| HSA Family Contribution Limit | $8,550 |

Bluegrassvw

Lil-Rokslider

you all are missing the boat(s)

RCL

CCL

NCLH

Also, AMD is solid, but for whatever reason, the street hates on it. It'll have its day.

RCL

CCL

NCLH

Also, AMD is solid, but for whatever reason, the street hates on it. It'll have its day.

I used to frequent this thread alot more at the beginning of the year then kinda forgot all about it, very interesting stuff to say the least. Cool to see roksliders doing well. I have a couple of the “investment apps” with very little $ in anything but am not 100% opposed to putting more in. If anyone has any tips or pointers I’m all ears, feel free to pm. With this being new to me it seems overwhelming.

Hypothetically if a guy had $5-10k sitting idle what should the first step be??

Hypothetically if a guy had $5-10k sitting idle what should the first step be??

Similar threads

- Replies

- 91

- Views

- 5K

- Replies

- 2

- Views

- 423

- Replies

- 38

- Views

- 2K

R

Featured Video

Latest Articles

- Titanium Suppressor Shootout

- Best Gear of 2025

- Swarovski AT Balance Review

- YETI Outdoor Kitchen Expansion

- The Art of Shed Hunting

- TT#72 Conquering the Super 10: Mike Kentner’s Hunting Journey

- Spring Black Bears with Joe Kondelis

- TT#71 Trail Goods Company – Partnering with Hunters for Epic Adventures

- Wyoming Elk with Biologist Lee Knox

- First Lite North Range Puffy Coat Review