It's hard to back out due to FOMO but man this train has to derail...right? At least most of us weren't holding cash through April-May hahaI agree and think it looks a lot like the dot com bubble shooting straight up. If we end up on widespread lockdown, we will have a fast and furious correction. In that case, more opportunity for crazy gains again. Hard to tell what will happen, It’s the craziest market I’ve ever seen. Good news out, stocks drop, bankruptcies everyone races in, craziness

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Rokslide Stock Traders Thread

- Thread starter Kilboars

- Start date

DenverCountryBoy

WKR

- Joined

- Jun 17, 2017

- Messages

- 1,272

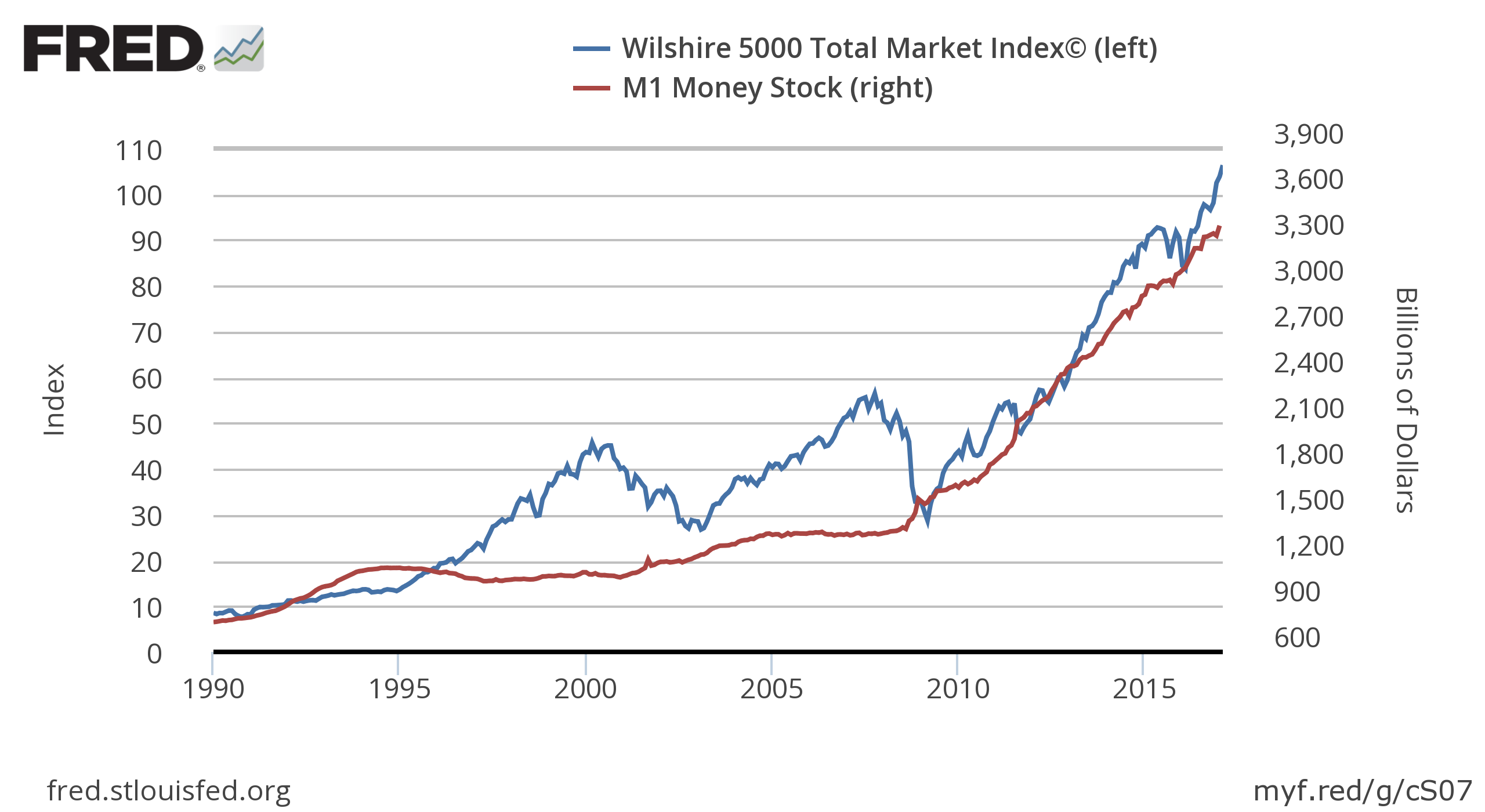

It doesn't take into account inflation from QE1-QEinfinity and the recent trillions the fed printed.

Stock Market Crash 2020: Welcome To The End Game

The Nasdaq is on its final run and is going vertical--a classic end of bubble move.www.forbes.com

Thoughts on this? I don't see how prices keep going up with no business profit to back it.

Sent from my SM-N960U using Tapatalk

Last edited:

Beendare

"DADDY"

It does seem like a game of Musical Chairs in names like Tesla.

I think the markets will go into a funk here shortly....the uncertainty of the election being one reason. A Biden presidency will kill the economy and with the huge base of DEM's, its a possibility. [though I cannot imagine]

I typically don't like to sell my long term stuff in taxable accounts, instead just sell covered calls and ride it out in stocks like BABA, GOOG and TCEHY with big gains....but it might be prudent here.

______

I think the markets will go into a funk here shortly....the uncertainty of the election being one reason. A Biden presidency will kill the economy and with the huge base of DEM's, its a possibility. [though I cannot imagine]

I typically don't like to sell my long term stuff in taxable accounts, instead just sell covered calls and ride it out in stocks like BABA, GOOG and TCEHY with big gains....but it might be prudent here.

______

CorbLand

WKR

- Joined

- Mar 16, 2016

- Messages

- 9,574

I have transition most of my stuff to long term holds, so if the market crashes it sucks but I can just ride it out. Only have 400 in short term stuff so if it crashes I am not out much. Still have about 3000 sitting on the side line waiting for another dip like March.

AdCornish65

FNG

Hello, even today you can make a lot of money on short term moves , it is a pretty risky job. A couple of months ago I bought some Amazon stocks, and today I don’t regret it. Because investing in such big companies can be a slower, but it is 80% sure investment ( if you are looking for long term trading operations).

huntaholic123

WKR

Grabbed some TOPS on the dip.

jackle1886

Lil-Rokslider

- Joined

- Jan 29, 2016

- Messages

- 266

Once I pull cash out for another real estate property I'll have some left in my account. Any thoughts on buying up stocks for the dividend while I wait for a big market correction? Or do we think most of not all dividends are either suspended or severely cut for the indefinite future?

Sent from my SM-N960U using Tapatalk

Sent from my SM-N960U using Tapatalk

Once I pull cash out for another real estate property I'll have some left in my account. Any thoughts on buying up stocks for the dividend while I wait for a big market correction? Or do we think most of not all dividends are either suspended or severely cut for the indefinite future?

Sent from my SM-N960U using Tapatalk

I’ve got some money parked in DIV for the short term. I’ll let you do your own DD on it. IMO you would be better going with a high dividend ETF vs individual equities with a high dividend due to downside risk in times like these. Do a search for low volatility/ high dividend ETFs as well.

Ariettabob

WKR

One of you experienced guys posted a link to a primer on learning candlesticks. Google has a staggering number of articles but I’d like one that you guys feel is a good one. Could you please repost the link?

BrokenArrow

WKR

Holy Moderna volatility,

I have been throwing out puts/calls all day. Had a day off work.

4 - 100%+ returns. Finally feeling comfortable with options. Trying to capitalize Before a full shutdown happens or an election sell off.

If one can learn debit and credit spreads, you can limit risk to a very tight window. It is however still a risky situation that delivers cash returns quickly.

I have been throwing out puts/calls all day. Had a day off work.

4 - 100%+ returns. Finally feeling comfortable with options. Trying to capitalize Before a full shutdown happens or an election sell off.

If one can learn debit and credit spreads, you can limit risk to a very tight window. It is however still a risky situation that delivers cash returns quickly.

CorbLand

WKR

- Joined

- Mar 16, 2016

- Messages

- 9,574

My buddy tried to convince me to buy Moderna when it was around 30 a share. Should have listened.Holy Moderna volatility,

I have been throwing out puts/calls all day. Had a day off work.

4 - 100%+ returns. Finally feeling comfortable with options. Trying to capitalize Before a full shutdown happens or an election sell off.

If one can learn debit and credit spreads, you can limit risk to a very tight window. It is however still a risky situation that delivers cash returns quickly.

Johnboy

WKR

- Joined

- Dec 12, 2014

- Messages

- 544

One of you experienced guys posted a link to a primer on learning candlesticks. Google has a staggering number of articles but I’d like one that you guys feel is a good one. Could you please repost the link?

Here's the one that I used a few months ago to get familiar with them.

Ariettabob

WKR

Thank you! It only took a couple of bad moves on my part to realize I need more educationHere's the one that I used a few months ago to get familiar with them.

Doc Holliday

WKR

- Joined

- Jun 15, 2016

- Messages

- 3,060

Holy Moderna volatility,

I have been throwing out puts/calls all day. Had a day off work.

4 - 100%+ returns. Finally feeling comfortable with options. Trying to capitalize Before a full shutdown happens or an election sell off.

If one can learn debit and credit spreads, you can limit risk to a very tight window. It is however still a risky situation that delivers cash returns quickly.

Definitley glad I picked some up yesterday

Johnboy

WKR

- Joined

- Dec 12, 2014

- Messages

- 544

Soooooo glad I didn't sell FET at a break even earlier this week!

EastMT

WKR

Soooooo glad I didn't sell FET at a break even earlier this week!

Nice job on the paytience! You selling now or holding for a while longer?

EastMT

WKR

I didn’t get much done today, finish up work and drive back home. I get to be back in my Reg job, working nights next week! Be much better for stock plays. It’s been a slow few weeks trading, I’m ready to get back into it.

Picked up some LCA last night for a longer hold

Picked up some SINT on this mornings dip. Was down most of the day a few %, up a bit tonight.

Cashed out BBGI, it seems to drop under $2, then rebound for 10-15% here lately.

Cashed CRK out for almost 20% yesterday.

Picked up some LCA last night for a longer hold

Picked up some SINT on this mornings dip. Was down most of the day a few %, up a bit tonight.

Cashed out BBGI, it seems to drop under $2, then rebound for 10-15% here lately.

Cashed CRK out for almost 20% yesterday.

Johnboy

WKR

- Joined

- Dec 12, 2014

- Messages

- 544

Nice job on the paytience! You selling now or holding for a while longer?

I'm holding. Between CDEV, FET and GTE, if two out of three survive and approach healthy production, I'll be in really good shape.

ryanbauman23

Lil-Rokslider

Soooooo glad I didn't sell FET at a break even earlier this week!

Similar threads

- Replies

- 91

- Views

- 6K

- Replies

- 5

- Views

- 892

- Replies

- 2

- Views

- 457

Featured Video

Latest Articles

- How Old Was He Really? Big Buck Hunters Talk Age vs. Score

- Banning Hunting Technology in Idaho?

- Best Gear of the year Rokslide staff edition 2025 Article

- Hunting Gear: Insights from Western Hunting Expo

- Black Diamond Alpine Start Insulated Hoody Review

- Tenacity Firearms with Andrew Whitney

- The Thrill of Moose Hunting with Henry Ferguson

- Final Rise Upland Hand Muff Review

- Kodiak Deer Hunt Round II

- Killing a Timber Giant