CEP up 100% so far today.

Sent from my iPhone using Tapatalk

of course it is! I stared at it and got cold feet.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

CEP up 100% so far today.

Sent from my iPhone using Tapatalk

I bought 4k of CEP in my IRA on Wed. Today its worth 8k. It may take a hit when it converts to XXI but I'm going to let it ride.View attachment 870685

I’ll put this here too, because I like you guys

Sent from my iPhone using Tapatalk

I bought 4k of CEP in my IRA on Wed. Today its worth 8k. It may take a hit when it converts to XXI but I'm going to let it ride.

I buy SCHD in my Roth, it is a dividend etf. There are others as well.Anyone into dividend income stocks? I have thought about moving most of my HSA into the market. I don't use the money as I want to keep it growing until retirement. I pay for any medical bills with money in savings but am leaving enough in the HSA to cover one years out of pocket max just in case. I also don't want to go high risk. I am putting current payroll contributions into the S&P but have $15K I want to move as well.

That brings me to dividend stocks. This seems like a good way to go but I would like some opinions. If you are positive on this idea what are your top stocks? If you are not on team dividends what would you do?

Give me MSTY or give me death.Anyone into dividend income stocks? I have thought about moving most of my HSA into the market. I don't use the money as I want to keep it growing until retirement. I pay for any medical bills with money in savings but am leaving enough in the HSA to cover one years out of pocket max just in case. I also don't want to go high risk. I am putting current payroll contributions into the S&P but have $15K I want to move as well.

That brings me to dividend stocks. This seems like a good way to go but I would like some opinions. If you are positive on this idea what are your top stocks? If you are not on team dividends what would you do?

I keep 1k in cash in my HSA and the balance is in FBTC, MSTR, TSLA and a few other high risk high potential growth stocks. I'm going to put this years contribution into MSTY and PLTY and have the monthly dividends go to my HSA cash account for anticipated medical expenses.Anyone into dividend income stocks? I have thought about moving most of my HSA into the market. I don't use the money as I want to keep it growing until retirement. I pay for any medical bills with money in savings but am leaving enough in the HSA to cover one years out of pocket max just in case. I also don't want to go high risk. I am putting current payroll contributions into the S&P but have $15K I want to move as well.

That brings me to dividend stocks. This seems like a good way to go but I would like some opinions. If you are positive on this idea what are your top stocks? If you are not on team dividends what would you do?

I buy SCHD in my Roth, it is a dividend etf. There are others as well.

I have as well. Looking for some safer stocks with higher yield. Thinking of buying some Pfizer, maybe Dow and something in energy.I buy SCHD in my Roth, it is a dividend etf. There are others as well.

ARCC and OXSQAnyone into dividend income stocks? I have thought about moving most of my HSA into the market. I don't use the money as I want to keep it growing until retirement. I pay for any medical bills with money in savings but am leaving enough in the HSA to cover one years out of pocket max just in case. I also don't want to go high risk. I am putting current payroll contributions into the S&P but have $15K I want to move as well.

That brings me to dividend stocks. This seems like a good way to go but I would like some opinions. If you are positive on this idea what are your top stocks? If you are not on team dividends what would you do?

MO, ABBV, TROWI have as well. Looking for some safer stocks with higher yield. Thinking of buying some Pfizer, maybe Dow and something in energy.

Look at ENB and KMI. I'd go with ENB if I only had to pick one.I have as well. Looking for some safer stocks with higher yield...something in energy.

ET (Energy Transfer).something in energy.

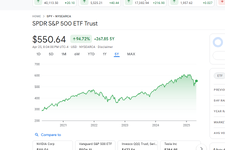

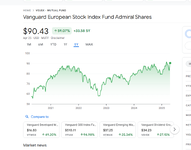

Hmmmm......you sure about the SPY to VEUSX comparison?You guys are overlooking europe stocks or mutual funds. veusx is a vanguard europe fund and i put 60K into it beginning of january...its up 14% YTD. pretty darn good as compared to the sp500 or QQQ. europe and international is going to outperform most of usa stocks for the next few years, possibly the next decade. im not talking any penny or super risky stocks or funds here. not everyone wants or needs those. forget about gold at this point...that ship sailed i believe.

Definitely no insider corruption going on here....There’s currently only one car company that’s more than a car company who hits over the 85% mark. Tesla, could be why there was a decent pump this afternoon