WyoBowhunter21

WKR

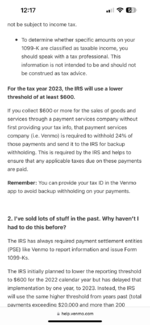

How is everyone managing the new tax law? I am trying to sell my Cimarron and needed to use goods and services. With the new tax code, I would be hit with a 24% income tax on $800. That’s $192. Plus the shipping, and PayPal fees. Just wanted to hear some thoughts and discussion as I am pretty frustrated right now. How does our future of selling gear look?