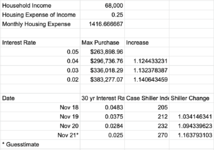

I feel like some of you guys need to give yourself some grace for renting. It's not as much "throwing money away" as you think. An example above was looking at 420K home with 50K down.

Even being really generous with a 2.75% rate, that's still 10K a year in interest. Gone. That 2.75 rate isn't exactly free money when you pencil it out. Tack on another $300-$400 a month in taxes and another $100 a month for home insurance. Plus another $100 or so for PMI. You're looking at basically $1300-$1400 a month that's not going towards principal. Throw away money to the bank, government, and insurance companies. That doesn't cover upgrades and things that just always break. So if you're renting for around $2K, you're only "throwing away" about maybe $500. That's with no liabilities and no risk. Seems like a good deal to me.

It was hard for us to justify not renting until we bought our house at 32 years old. And when we did, our realtor and mortgage company laughed at what we put our max loan amount at. I just can't stand paying huge chunks of interest to the bank. I hope it all works out for guys looking to buy, and I know everyone wants something that's theirs, but I personally wouldn't chase something. So you could over pay $50K for a house now to save that $500 a month; Or wait a year or so and "throw away" that $6K worth of rent money and potentially save $50K on your house (probably save that 6k in interest payments). Just giving an example to hopefully ease some stress. And obviously that assumes the market comes down. But I have little faith in our economy right now.

There are a lot of big money guys that look at a house as a trap the bank has set on the middle class and a huge liability. They will never own a house. They would rather have that $500K in an investment and have it pay their rent with no liability. Some of them have a very good argument. Grant Cardone and Robert Kiyosaki are a couple guys worth listening to their thoughts on home ownership.