Elkangle

WKR

- Joined

- Jun 16, 2016

- Messages

- 971

These threads with guys chasing there dreams is awesome, pretty cool to see guys with some guts go out and do it

But incase your not digging the risks there is another way..while finances are a touchie subject, I think if anyone is considering these hunts it's kinda par for the course.

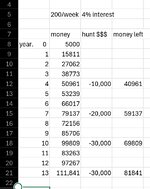

Either way heres a simple chart showing 200 a week into a simple index with 4% returns and how much you can with drawl and still keep climbing..obviously depending your age and income you can tweak it

That's a 10k towards a trip on year 4

20k towards a trip on year 7

30k towards a trip on year 10

And then you can pretty much do 30k trips every 2-3 years after that pluss some

If you have the time, this would be a pretty decent way to live a heck of a life if you can carve out the weekly $

But incase your not digging the risks there is another way..while finances are a touchie subject, I think if anyone is considering these hunts it's kinda par for the course.

Either way heres a simple chart showing 200 a week into a simple index with 4% returns and how much you can with drawl and still keep climbing..obviously depending your age and income you can tweak it

That's a 10k towards a trip on year 4

20k towards a trip on year 7

30k towards a trip on year 10

And then you can pretty much do 30k trips every 2-3 years after that pluss some

If you have the time, this would be a pretty decent way to live a heck of a life if you can carve out the weekly $

:max_bytes(150000):strip_icc()/howtoopenonlinebrokerageaccount-3075fa1a9fa4447293ccee1838a226ec.jpg)

:max_bytes(150000):strip_icc()/Brokerageaccount_final-b1881bdb86e546f28c9e5419c83a0b36.png)