stalkingwolf

FNG

- Joined

- Aug 4, 2025

- Messages

- 84

I just mirror Nancy Pelosi's buys and I never lose

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

What made you sell? Just taking some profits along the way? Curious to yours and others thoughts mid to long term on VGT.Correct. I bought it I believe in 2018 and havent touched it

Sent from my SM-G990U using Tapatalk

I sold for personal reasons. Nothing to do with the market. I needed some money for some stuff and I've done so we'll with VGT as a long term hold I figured why not.What made you sell? Just taking some profits along the way? Curious to yours and others thoughts mid to long term on VGT.

If you needed money, you pay the tax and move on.I sold for personal reasons. Nothing to do with the market. I needed some money for some stuff and I've done so we'll with VGT as a long term hold I figured why not.

If you needed money, you pay the tax and move on.

I think that we will continue to use more and more tech in years to come. I think it's a great strategy to Dollar cost average into QTEC and VGT. QTEC is less concentrated so I tell my nieces and nephews to do a blend of those 2 along with VOO.

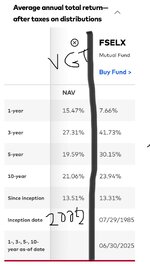

I did a comparison on the Vanguard website just against the VGT and this is after tax returns based on the highest tax rate.pay tax on the gains from sales every year which chips away at your invested base. In an ETF you pay no tax until you sell

You can cherry pick ETF’s and Mutual Funds for either argument. What Beendare was saying is that taxes are easier to plan for with an ETF.Nothing to read into it. it just an honest question @Beendare. You mentioned the taxes on gains and the fees and I looked at that comparison and asked the question if there was something I was missing. Trying to learn.

I see the screenshot isn’t showing for me now.

You can cherry pick ETF’s and Mutual Funds for either argument. What Beendare was saying is that taxes are easier to plan for with an ETF.

That particular Mutual Fund (FSELX) you chose is over 25% Nvidia — which is one reason it has done so well. If the mutual fund itself sells some of those Nvidia shares to rebalance its portfolio, every single person who holds shares of that mutual fund will be liable for capital gains taxes. (Even if you didn’t sell shares of the fund yourself). This does not happen with an ETF. You will only incur taxes when you sell your own shares. You can google the differences to see why, but it boils down to ETF’s can leverage “like kind exchanges” while mutual funds cannot.

Mutual funds also typically cost you more to be a part of. That mutual fund costs you 0.62% (expense ratio) per year, while VGT costs you 0.09%. Not a huge difference in this case, but some more actively managed mutual funds can be pretty expensive — which can chip away at your gains. Some people want actively managed portfolios with people or companies they trust and are willing to pay the higher fees and incur the tax liability that comes with it.

There’s more pros and cons, but google them if you want more detail. But that’s the gist of it.

One of my ETF's is ok at 14% - VTI

The other, not so much - SCHD. I bought it several months ago and it has continued to not impress me. It was supposed to be a long term hold and dividends are supposed to be good, but I'm not so sure.

Anyway, I got into this late in life and don't know what I'm doing.

I'm thankful for the information shared here and I continue to learn...and then forget.