SWFLhntr

Lil-Rokslider

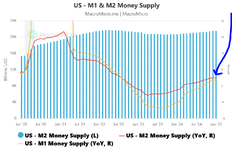

Hmm I just had to right a check for my 2024 SEP. probably wait a week on the rest of my Roth for 2025. MSTY at $19

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

There is a ton of trash coins. I’ve chosen XRP, which is created by Ripple, because of the utility. It allows for cross border payments and transactions that happen instantly.What's up with crypto?

bravenewcoin.com

bravenewcoin.com

There is a ton of trash coins. I’ve chosen XRP, which is created by Ripple, because of the utility. It allows for cross border payments and transactions that happen instantly.

Key Features Of Ripple

“Ripple's architecture brings three main advantages to global transactions: speed, cost-effectiveness and scalability. These features make it a compelling alternative to traditional banking systems and other cryptocurrencies, particularly for financial institutions handling large volumes of cross-border payments.”

Speed And Efficiency

“Ripple processes transactions in 3-5 seconds through its consensus mechanism, compared to Bitcoin's 10-minute block time or traditional banking systems that can take days. This speed comes from XRP's unique validation process that doesn't require mining. The network can settle over 1,500 transactions per second, making it practical for banks' real-time payment needs.”

I rolled the dice four years ago at .35¢ a pop. Now it’s hovering between $2.20 and came up to $3.50 ish. Could get much higher when they get through the SEC lawsuit they are involved in. Anyway, as always do your research. I use Coinbase and Uphold to trade and store. You’ll want a wallet too, for storage. Also, I tell no one about my “bag” not even a best friend or a spouse. Three factor identification on every app I use. Happy to answer any questions as best as I can.

Here is an article that came out today, worth a read.

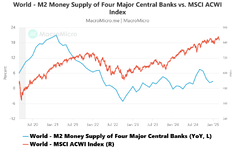

We are like 2.5% off ATH we haven’t seen nothing yetBlood in the streets.

Probably time to buy again.

We are like 2.5% off ATH we haven’t seen nothing yet

They'll be jumping out of buildings when it gets real badTrue but people act like it’s all over haha, still good time to nibble

Sent from my iPhone using Tapatalk

I’m not concerned. It would be difficult to move the price without having to dump billions of coins at a single time. There is a hard cap of 1 billion coins that can be released every month. They have never come close to that. XRP is competing with BTC and ETH and If I have learned anything from my small foray into crypto currencies, it is that people are absolute fanatics about the coins that they believe in. And will do everything in their power to make you believe that anything that’s possibly good about your favorite coin is actually horrible and you should dump your bag right this second.What are your thoughts on ripple owning at least 55% of the supply?

If it ever drops below $2 again. But, might just have to be now.I’ve been holding out to find a time to enter

Sent from my iPhone using Tapatalk

If it ever drops below $2 again. But, might just have to be now.

I came real close to dumping when it peaked a couple of weeks ago. I got in so cheap that I’m just going to hold.Missed this. Lol. But it’s lower since you posted

That $1.79 on the daily EMA is what’s got me hesitant. If it were to head down to that I’d full port my little account in and let her ride back to above $3 and take my profit.

Sent from my iPhone using Tapatalk