These things.

1. It took me until my early 50s to understand the point of my 401k is to contribute as much as the IRS allows, not just enough to get matching. It would have been more tight on a monthly basis, but I’d be awash with money now. And, a Roth 401K is taxable going in, but growth is not taxed.

Again, had I known that, I’d be swimming in cash. I’ve converted all of my accounts into Roth IRAs now (know the rules!) and took a big tax hit on the gains in the process. However, by the time I need them, tax-free withdrawals will sustain me for life.

2. Get investors business daily (IBD) and follow their methodology in general, and certainly if you follow the “sell at 20% gain and buy something else” school of stock trading.

IBD’s daily “Stocks on the move” list with research on tradevision is how I pick winners.

3. Watch “Felix and friends” on YouTube, get tradevision.io, and follow his methodology to see which stocks (and ground truth with IBD) you should be invested at any given time. His is a momentum play, but it works.

Trade vision will also tell you if buy and trade or buy and hold has been better for a specific stock over the last few years. Important info. You’ll find some of them are legitimate buy and hold.

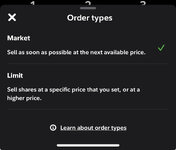

4. Stop losses are a thing. Have rules and follow them. They keep winners from becoming losers. I made a lot of money last year trading. But, almost all of my losses were from violating my own rules with emotional or FOMO buys. And then either not setting a stop loss (letting them run), or having had a stop loss execute, getting back in and setting a still lower stop loss and loosing more. I now have a rule about not getting back in on a stock, even if I think it’s reversing higher, for two weeks minimum. Do I miss some ups? Yes. Do I miss more downs or falling knives? Absolutely.

Finally, look at the ETF “CHAT” Heavy tech (think VGT), with a bias toward AI companies. Top holdings are nearly the same, but lots of generative AI smalls with potential to grow.