Sherman

WKR

- Joined

- Jul 15, 2021

- Messages

- 634

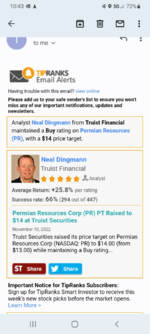

Happy birthday!!!!Excellent, thanks for the clarification. Happy for your success with PR, that's great stuff.

I'm 59 as of *today* lol, so my goals are different and don't plan on holding this thing forever, but that kind of divi declaration will def add value for possible institutional investors.

Huge upside.