I’m a title attorney for various oil and gas companies. I run title before the well is drilled to ensure ownership and leasing, and then after completion to make sure payments are correct to all parties.

I am obviously a contrarian as to what benefits me personally compared to the average citizen. All goes back to the old saying about whose ox is getting gored I suppose. I made my mark right at the right time in my industry. Just luck really.

I’m not sure what is going on in the world and who wants what and what their real motivations are, but I was kind of a fan of keeping my situation stable for as long as possible. That situation has change dramatically this last year. Luckily I’m ready to retire so it’s moot really. But I damn sure don’t want my investments going down so I am highly diversified to minimize risk.

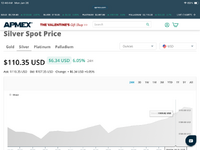

As you know, an increase in precious metals is a proverbial flight to safety in times of uncertainty.

I don’t disagree with some things the administration is doing but why all the drama.

Way back in my army days, some units used to cycle up and down drastically in readiness. Some were ready to be deployed on a hot call. Others were non deployable bc they were in a maintenance/support cycle or training cycle. It created this inefficient readiness cycle. The army then went to what they called the “band of excellence” or something like that nomenclature where they tried to keep most units (not counting RGR, SF) at a 85% to 90% readiness rate with a smaller standard of deviation. Have no idea if that is still utilized but it made sense to me and still does.

I guess I’m just an old fudd and just like my coffee and the economy not too cold and not too hot.

Of course with AI and robotics inbound, the average person is probably about to get a massive haircut. I think Elon is full of shit. His impression that wages and retirement will be antiquated are wrong. I think many people are about to get hurt economically and make the divide between the haves and have-nots very deep.