5MilesBack

"DADDY"

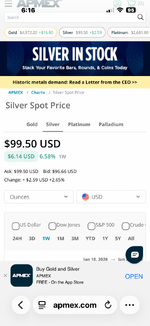

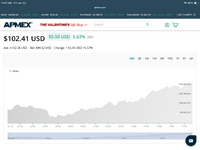

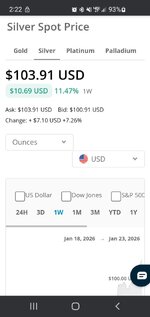

It was easy buying if you were buying 5+ years ago with smaller commissions, mostly 0-3%. The last few years their 'sell to customer' commissions spiked up hard. I was seeing some silver commissions at 30%. Easy pass on those.I sold 100oz last Thursday had to drive 3 hours one way to find a dealer that wasn’t $10 back of spot. It was easy when I was buying not so easy on the sell side.