Dont even think about itEdit, Grand Junction area looks to be the only place that also has a decent size economy to make a living.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Pay off mortgage or make monthly payments and invest the rest?

- Thread starter Ucsdryder

- Start date

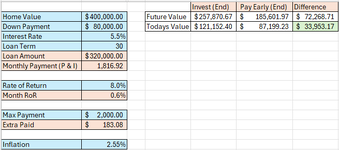

The numbers will tell you to invest the extra money instead of pay off early, assuming the interest rate is not crazy. Here is an example on mortgage on a $400,000 home with 20% down ($80,000) for a loan amount of $320,000.

The assumptions are shown in the picture below in BLUE. I did not include taxes and insurance in the monthly payment because you will be paying those no matter what. The S&P500 has historically returned just over 10% but I used a more conservative number of 8%.

In this example, a person can use the extra $183.08 to invest every month or to pay off the loan early and then invest the full $2,000 after the loan is paid off.

After 30 years, this person will have $72,269 extra money in the account if they invested the extra $183.08 right away. For better reference, the $72,269 would be $33,953 in todays dollar.

Psychologically, most people believe they are more secure if they pay off the loan faster. However, I disagree. In addition to having more money, someone could pull from the investment account if an unfortunate event happens (medical, lost job, etc.). The paying off early situation would not have money in the investment account until year 25. Once you pay extra money to the mortgage, that money is gone. Not technically, because you can pull from the equity but that is significantly more difficult.

The assumptions are shown in the picture below in BLUE. I did not include taxes and insurance in the monthly payment because you will be paying those no matter what. The S&P500 has historically returned just over 10% but I used a more conservative number of 8%.

In this example, a person can use the extra $183.08 to invest every month or to pay off the loan early and then invest the full $2,000 after the loan is paid off.

After 30 years, this person will have $72,269 extra money in the account if they invested the extra $183.08 right away. For better reference, the $72,269 would be $33,953 in todays dollar.

Psychologically, most people believe they are more secure if they pay off the loan faster. However, I disagree. In addition to having more money, someone could pull from the investment account if an unfortunate event happens (medical, lost job, etc.). The paying off early situation would not have money in the investment account until year 25. Once you pay extra money to the mortgage, that money is gone. Not technically, because you can pull from the equity but that is significantly more difficult.

Just put an offer five blocks away from yaDont even think about it

You overpaid thenJust put an offer five blocks away from ya

TimberRunner

Lil-Rokslider

- Joined

- Aug 6, 2024

- Messages

- 131

We've had this conversation several times. We have a super low interest rate, so it doesnt make sense. As stated, its very individual.

But after reading this thread, do people who want to pay off their mortgage completely (debt averse), do they also share the same attitude towards the volatility of the equity market, avoiding them?

Therefore, moving towards more conservative investments and missing out on the potential 8-10% gains? Instead investing in ultra short term bonds or similar, getting 4.5% returns?

I suppose you could want to eliminate debt and not have any issue with the equity markets, but for some reason, those don't seem on par.

But after reading this thread, do people who want to pay off their mortgage completely (debt averse), do they also share the same attitude towards the volatility of the equity market, avoiding them?

Therefore, moving towards more conservative investments and missing out on the potential 8-10% gains? Instead investing in ultra short term bonds or similar, getting 4.5% returns?

I suppose you could want to eliminate debt and not have any issue with the equity markets, but for some reason, those don't seem on par.

I totally agree. You will be far a head in 20 years with your index funds.I’d invest it. Especially during this dip. About 5 years ago I had $260k and was going to outright pay off my house just for the peace of mind. I decided to put my feelings aside and just refi to a 15 year 2.25% interest loan and invested the whole lump sum into just a general index fund. It’s made well over $100k in those 5 years.

I’m also doing an additional $2k a month into the fund, that could easily just go to my mortgage. But it simply just doesn’t make sense. The market, in general, should outpaced the 2.25 interest pretty easily over time.

huntnful

WKR

- Joined

- Oct 10, 2020

- Messages

- 3,577

Made $240k in 5 years in the index funds off that initial investment, doing basically nothing. And I’ve paid $24k in interest over that same period. I’d say it was an excellent call and I’m glad I made that decision at the time.I totally agree. You will be far a head in 20 years with your index funds.

Stop doing math!Made $240k in 5 years in the index funds off that initial investment, doing basically nothing. And I’ve paid $24k in interest over that same period. I’d say it was an excellent call and I’m glad I made that decision at the time.

That doesn’t “feel” good though

Coopsdaddy

WKR

Been in a very modest home for 25 years.Its been paid for 20.

We want to semi retire and move in 3-4 years and can buy or rent.

I wont have a house payment and that’s from the emotional mindset and how I grew up.Debt stresses me out.

We are contemplating renting as well.If we took the money from the house and the cash we would add to it for a new home and could invest that and have 1/2 or more of our rent.

Than if we were not paying Innsurance,maintenance and taxes that pays another chunk so our rent would not be alot out of pocket.

There something to be said about that option to.

Yes we are not getting equity but we also are not going to be getting equity like we have in the last 5 years.Plus no maintenance!

We want to semi retire and move in 3-4 years and can buy or rent.

I wont have a house payment and that’s from the emotional mindset and how I grew up.Debt stresses me out.

We are contemplating renting as well.If we took the money from the house and the cash we would add to it for a new home and could invest that and have 1/2 or more of our rent.

Than if we were not paying Innsurance,maintenance and taxes that pays another chunk so our rent would not be alot out of pocket.

There something to be said about that option to.

Yes we are not getting equity but we also are not going to be getting equity like we have in the last 5 years.Plus no maintenance!

whaack

WKR

If you have a 2-4% mortgage I’d be investing that money.

I think you have to look at all angles. Most people forget the capital gain exemption you get from a primary residence.

A married couple using the home for a minimum of 2 years can exempt up to $500,000 of capita gains.

Lets say you pay $300,000 for a house....you sell it for $800,000...minus fees to sell it, lets say 10% $80,000...

You net $420,000 in capital gains tax free. If the house was paid off...you net $720,000 tax free.

Only a roth IRA allows for tax free withdrawals...with requirements....but the money can only go in after you paid taxes on it in the first place.

A $500,000 investment gain is taxed at around 40% (depending on investment types) (fed and state) = $300,000 net.....and as far as I can tell taxes never go down....

So the answer is complicated. My house is paid off. I am investing the old mortgage now. To me now it makes sense to do so. I have the added benefit of cash I'm not paying to the mortgage company for incidental repairs, tags, trips, etc.

Of course your MMV....

A married couple using the home for a minimum of 2 years can exempt up to $500,000 of capita gains.

Lets say you pay $300,000 for a house....you sell it for $800,000...minus fees to sell it, lets say 10% $80,000...

You net $420,000 in capital gains tax free. If the house was paid off...you net $720,000 tax free.

Only a roth IRA allows for tax free withdrawals...with requirements....but the money can only go in after you paid taxes on it in the first place.

A $500,000 investment gain is taxed at around 40% (depending on investment types) (fed and state) = $300,000 net.....and as far as I can tell taxes never go down....

So the answer is complicated. My house is paid off. I am investing the old mortgage now. To me now it makes sense to do so. I have the added benefit of cash I'm not paying to the mortgage company for incidental repairs, tags, trips, etc.

Of course your MMV....

Amos Keeto

WKR

- Joined

- Dec 13, 2023

- Messages

- 576

I think it's all about "dollars and cents" (sense?)My wife and I made the decision to pay off the house vice investing. We did it for the emotional relief of outright ownership.

It’s not all dollars and cents.

P

We sold out when the kids left. Family deeded us land. We paid them rent until they passed.

With the money from the sale of our home, we built our own.

At 75 and 76, our home is paid, our rent is once annual property taxes.

Instead of house payments, we make "gun safe" payments.

Use that cash to buy and sell for profit, convert to gold or silver or just sit on it or just simply enjoy it! Vacations or trips!

We bought our home on a 20 year loan. We used the interest on the loan as a tax write-off. Sadly, after about 8 years, home loan interest wasn't sufficient to use as a tax write-off any longer.

We had to go back to just short form tax returns.

It isn't making us millionaires by any means, but it sure is nice to have a pad for wants, needs and uh-oh's! LOL!

P.S. - To me, anything you can do to hang on to your own money is a plus!

I agree this is far too often overlooked. I have friends who have sold homes and paid capital gains taxes on them just because they didn’t know (or choose not to have someone help with taxes).I think you have to look at all angles. Most people forget the capital gain exemption you get from a primary residence.

A married couple using the home for a minimum of 2 years can exempt up to $500,000 of capita gains.

Lets say you pay $300,000 for a house....you sell it for $800,000...minus fees to sell it, lets say 10% $80,000...

You net $420,000 in capital gains tax free. If the house was paid off...you net $720,000 tax free.

Only a roth IRA allows for tax free withdrawals...with requirements....but the money can only go in after you paid taxes on it in the first place.

A $500,000 investment gain is taxed at around 40% (depending on investment types) (fed and state) = $300,000 net.....and as far as I can tell taxes never go down....

So the answer is complicated. My house is paid off. I am investing the old mortgage now. To me now it makes sense to do so. I have the added benefit of cash I'm not paying to the mortgage company for incidental repairs, tags, trips, etc.

Of course your MMV....

A bit more amplifying data here. It’s 2 of the last 5 years you need to live in it….but it’s pro-rated a bit too (12 months vs 24 months gets half the benefit, etc).

Most importantly military members who move away get a 10 year extension. So 2 of last 15 years for them. This makes it extremely profitable if you can hold on to the home for 15 years and then sell…..most likely completely tax free (up to $500k if cap gains anyway). And you can do this with multiple homes.

FWIW this wouldn’t be possible for most IF you spent all your saved $ on paying cash for a house (or paying it off).

But if you used those saved $ and the bank’s money to buy a handful of homes(leverage) and let them appreciate 100%+ over the last decade or so and sold them (has to be sold in different years). You used the bank’s money to make money (and not pay tax on it!). Now you have enough cash to never worry about a mortgage again (if you choose to)!

Yes the market could tank, but in most of our lifetimes it’s only happened once and it only took a few years to recover. Time is important here.

Your dollar gain is the exact same in either scenario, and return on capital would be higher with the mortgage.....I think you have to look at all angles. Most people forget the capital gain exemption you get from a primary residence.

A married couple using the home for a minimum of 2 years can exempt up to $500,000 of capita gains.

Lets say you pay $300,000 for a house....you sell it for $800,000...minus fees to sell it, lets say 10% $80,000...

You net $420,000 in capital gains tax free. If the house was paid off...you net $720,000 tax free.

Only a roth IRA allows for tax free withdrawals...with requirements....but the money can only go in after you paid taxes on it in the first place.

A $500,000 investment gain is taxed at around 40% (depending on investment types) (fed and state) = $300,000 net.....and as far as I can tell taxes never go down....

So the answer is complicated. My house is paid off. I am investing the old mortgage now. To me now it makes sense to do so. I have the added benefit of cash I'm not paying to the mortgage company for incidental repairs, tags, trips, etc.

Of course your MMV....

EDIT: re-read your post, there is just so much incomplete and bad info. Investment gains taxed at 40%?! What?

I think you have to look at all angles. Most people forget the capital gain exemption you get from a primary residence.

A married couple using the home for a minimum of 2 years can exempt up to $500,000 of capita gains.

Lets say you pay $300,000 for a house....you sell it for $800,000...minus fees to sell it, lets say 10% $80,000...

You net $420,000 in capital gains tax free. If the house was paid off...you net $720,000 tax free.

Only a roth IRA allows for tax free withdrawals...with requirements....but the money can only go in after you paid taxes on it in the first place.

A $500,000 investment gain is taxed at around 40% (depending on investment types) (fed and state) = $300,000 net.....and as far as I can tell taxes never go down....

So the answer is complicated. My house is paid off. I am investing the old mortgage now. To me now it makes sense to do so. I have the added benefit of cash I'm not paying to the mortgage company for incidental repairs, tags, trips, etc.

Of course your MMV....

That's not now this works. Your cap gains are the same whether or not you paid it off or had a loan on it...

Similar threads

- Replies

- 72

- Views

- 4K

- Replies

- 3

- Views

- 377

- Replies

- 1

- Views

- 379

- Replies

- 343

- Views

- 29K

Featured Video

Latest Articles

- TT#64 Josh Boyd Elk Hunting Strategies for Every Season

- Aaron Davidson of Gunwerks

- TT#63 Dirk Durham’s Art of Elk Calling

- BIG Buck Stories with the Dirty Giants Podcast

- TT#62 Brian Barney Hunting Bulls without Calling

- Hoyt Alpha AX-2 SD Review

- Kuiu Kenai vs Outdoor Vitals Vario Hooded Jacket Review

- Hoyt RX-9 Ultra Review

- Hunting Vampire Bucks & Building an Optics Kit

- Darton Sequel ST2 35 Review