While I agree that most dont have an extra grand to throw at mortgage, I ran the numbers if I did and its pretty surprising.

Current mortgage is 4.99%.

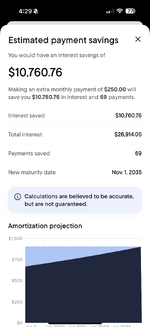

Minimum payment = total principle and interest = 747000. Pay off is 2052

Minimum plus 1000 = total principle and interest = 584750. Pay off is 2039

Savings between the two is 162300.

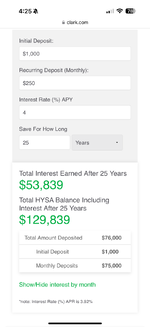

Now if I took that 1000 per month and could turn 4% yearly on it. It would be worth 685000 in 30 years which would be 2052.

Contributions = 360000

Interest = 325000

If I waited until my house was paid off and then threw my minimum payment plus 1000 into the same parameters as above from 2039 to 2052. It would be worth 610000.

Contributions = 468000

Interest = 142000

Just some realistic numbers for people to look at. Keep in mind that I also have a higher interest rate on my mortgage than what you can earn. Those that have them below what you can earn, go run your numbers.

Numbers are rounded to the nearest hundred for ease. Its also been a day, so if I did the math wrong, please point it out.