swampfoxsc

FNG

The fastest way to get rich is to go slow.

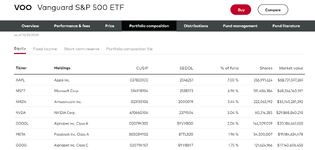

Boring is better. Save and plow funds into a low cost index fund. Can't time the market and highly doubt you have an edge on any single stock.

Boring is better. Save and plow funds into a low cost index fund. Can't time the market and highly doubt you have an edge on any single stock.