Good post. I should know better than to weigh in here - as taxes overlap politics to a great degree. But I've also got very poor judgment...

The government just passed a 1.7 trillion spending bill, the bill being over 4,000 pages long. The government and DoD specifically can only account for a shockingly low amount of assets and spending in a given year.

I think you hit the nail on the head right off of the bat. I believe spending is the primary problem, and if you spend, you have to print money and/or borrow, but ultimately the bill comes due and taxes are the source.

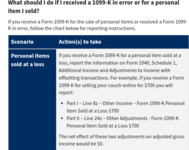

But somehow my potential $600 payment even if it’s all gain must absolutely be accounted for by the IRS. To accomplish making sure I pay my gains they’re giving the IRS $80 billion.

This is the part that sucks because, IMHO, it's just math. Unfortunately the only way to pay that bill via taxes is to tax everyone. Even if the tax rate is incredibly high, there isn't enough income among the "wealthy" (however defined) to produce enough revenue to cover annual spending.

If someone sells something for $1 million, $10k or $600 and it's all income, he's supposed to pay taxes on it. Same for if you work as a waiter and get a $10 tip. The results are not supposed to vary if the payment is in cash, or via Venmo. Is that fair? Probably a policy debate, but in any case not reporting and paying taxes is a personal moral decision - but technically wrong (and going way beyond taking advantage of a "loophole"). And yes, not reporting/paying is sticking it to the IRS, but really it's sticking it to everyone.

Then they claim the money given to the IRS is to go after the wealthy. Sure sounds great but the reality is the truly wealthy have lawyers and accountants that are top notch and “cheat” the system by utilizing the loopholes created by the system.

This is the primary reason I made the mistake of this post. In my opinion, I think this is a common misconception that there are special "loopholes" (which I don't even know what that means - deductions?) that are only available to the wealthy who hire lawyers and CPAs. Not true IMHO. But if there are some, I welcome learning about them.

Sure they might find an illegal scheme here or there and tangle up some athletes and Hollywood celebs but they won’t get at the true ultra wealthy.

The true ultra wealthy pay a lot in taxes. Sure, in some years the marginal rates are low, and there are exceptions. Like the often pointed to Elon Musk who was said to have not paid "enough" - until he sold a bunch of shares and incurred a huge income tax liability. Before that he didn't have income equal to what people perceive he did. And it's reported he used a "buy/borrow/die" approach to borrow against his stock (not income) with the hope that he could just hold off until death to avoid paying the capital gains. I hate that label, as it fails to consider interest carrying costs, and considerable risk (as the debts don't decline, but the stock certainly can - and did). Plus dying only avoids capital gains income taxes, not estate taxes.

Then they’ll look at how they can make up for the claimed expected tax profits, watch out medium to small family owned businesses. Wether republican or democrat I always see “x” official is giving “y” amount of money to Ukraine or to some foreign area that had a natural disaster. Well the government doesn’t give anything, the taxpayers do and they take credit for political score when applicable.

Totally agree. I think politicians view their jobs as acquiring, exercising and retaining power. Doing so means there are no real repercussions for behaving poorly or making bad decisions. My personal belief is that only term limits would help, but unfortunately they are unconstitutional for Congress.